This guide may contain affiliate links, please read my disclosure for more info

You’re starting to have an idea of your goals and time horizon. Now you need to choose a market to trade.

Video: Step 2 : Choose Market to Trade

Stocks, Bonds, Forex, Options, Futures, Cryptocurrencies, … what exactly are they and how can you choose ?

Let’s start looking at these different assets and what it means to trade them.

The tough thing about markets is the range of terminology used. It can sometimes be a little difficult to navigate in the ocean of technical jargon.

But I’ll try and keep this simple, and to start with I have great video for you to watch.

It has been made by William Ackman “Everything You Need to Know About Finance and Investing in Under an Hour”.

It’s a great piece of education well worth your time.

Here it is:

Clearly a great introduction to Finance and the Markets right?

Moving on, you still need to choose a market to trade. So, let’s try and understand the different assets that you could start trading:

Stocks

Also called equities, or shares, stocks are a small portion of the capital of a company. When you own a share of Microsoft, you own part of the company, you are a shareholder. And when Microsoft makes a profit and decides to distribute it to its shareholders you will earn a small profit per share, called the dividend. Owning stocks is one of the simplest forms of trading or investing. You simply choose a company that you think has a profitable future ahead. Then you buy a stock and hold it for as long as you want.

To get a better understanding of stock trading, I have a complete guide providing you with « 20 Ways to Learn Stock Trading ».

Bonds

A bond is different. When a company needs to borrow funds to finance its development, it has several options. It can go to a bank and get a loan, or it could float bonds on the market.

For example, Microsoft will decide to borrow $100 million on the market and will issue 1 million bonds worth $100 dollars each. To each investor (bond holder) Microsoft will pay an interest (called coupon), for example 2% per year, just like it would pay the bank an interest if it had taken a loan.

So if you buy a Microsoft bond, you’re actually lending Microsoft some money, and Microsoft will repay you that money at a specific period of time, let’s say in 5 years time (Bond maturity).

In the meantime, it will pay you the fixed interest, which is why Bonds fall in a category called « Fixed Income » products.

The risk you take when you buy a bond is that the company will fail to pay back its debt. That’s why companies that pay high interests are usually the most risky, the extreme case being “Junk Bonds”.

Forex

The forex market is the Foreign Exchange or currency market, where world currency pairs are traded against one another 24 hours a day (except weekends). A currency pair will be the EUR/USD for example, representing the exchange rate of 1 euro converted into US dollars.

It is one of the biggest markets out there and trades around the clock, which is very convenient if you have a day job. But it’s also one of the most risky, because you can usually trade with a lot of leverage. Leverage Is the concept of buying an asset for a fraction only of its cost, thereby multiplying your potential profit (and risk). If you’re interested, here’s an article on Leverage in the Foreign Exchange market.

If you’re specifically interested in Forex, you can check out my 12 Ways to Learn Forex Trading or you can start learning from the best and check out 17 Forex Traders you can emulate. My Great Big Success Page also has a list of the Top Forex Traders in the world or Hedge Fund managers, with links to their strategies, net worth, …

Trackers (ETF)

Trackers (also called Exchange Traded Funds – ETF) are a recent form of investment. Their popularity keeps growing thanks to their low-cost and tax efficient model. They are investment funds traded on stock exchanges, holding collections of securities (stocks for example) that usually replicate an index (eg. S&P 500), an industrial sector (eg. Healthcare) or a specific strategy (eg. High Yield dividend stocks). They are quite similar to mutual funds.

ETFs are a relatively simple way to trade when you don’t have time to look for individual stocks, but want to follow a specific sector (biotech, energy, …) or category of stocks (Dividend Aristocrats, …).

If you’re interested in knowing more about some recommended ETFs, check out this article on the Top 5 ETFs for 2020 on Bankrate.

And for an insight on ETFs you can read John C. Bogle’s (founder of Vanguard Group) « Little Book of Common Sense Investing ».

Options, Futures

Options and Futures are more complex assets to trade, they are called derivatives. That means they have an underlying asset, like stocks or bonds or Forex.

An option will give you the right to buy (call option) or sell (put option) a specific security at a precise price (strike price) at a specific point in time (expiry date). Futures will be quite similar, except that at expiry date you have to buy or sell the security.

Options are used in many different types of strategies, like hedging, income or speculation. As a highly leveraged product, options trading can be hugely profitable, but is is definitely not for novice traders, they demand quite a high degree of skill.

If you want to know more about options, here’s a list of the Best Options Trading Books.

Cryptocurrencies

We all know Bitcoin, the king of cryptocurrencies. But there are countless others.

In short, cryptocurrencies are internet-based mediums of exchange that use cryptography to conduct financial transactions. Cryptocurrencies use the blockchain’s technology to enforce decentralized, transparent and immutable transactions. The main idea behind cryptocurrencies is the absence of any centralized authority, making them in theory immune from government interference.

Cryptocurrencies can be exchanged very quickly, with low transaction fees and in a secured manner using a public key (similar to a bank account number) and a private key (similar to a transaction password).

They can also be traded on specific exchanges, their huge volatility making them both extremely dangerous but also potentially quite rewarding.

I have a few articles to help you better understand cryptocurrencies and how to trade them:

- What is Bitcoin: better understand the king of cryptos

- Why is Bitcoin a unique opportunity?

- The top cryptocurrency exchanges: where to trade cryptocurrencies

- Bitcoin’s wildest predictions: how some well-known punters price BTC above $100k

So, which one is best for you?

You need to choose a market to trade, but can’t seem to decide. Yes, it can be tricky, so let me help you:

- Choose Stocks if you like the idea of investing in a company or a product that you believe in, or in a CEO you trust. Stocks are a good option for long term investment or dividend strategies. If you think Amazon, Tesla, or Netflix will change the world, then their respective stocks give you an option to be a part of that story and profit from it. Amazon first listed at $18 in 1997, if you had invested $1,000 at that time, your investment would be worth a staggering $120,000 as of Q1 2020.

- Choose Bonds if you want a steady fixed stream of income with a risk level you can easily control. In an environment of very low interest rates, bonds can be a good way to diversify a portfolio with low risk assets and decent returns. But Bonds won’t make you rich overnight, so that might be a good option only once you have reached a certain level of funds.

- Forex will be your option if you want highly leveraged and therefore high risk trading, or if you want to trade news events from the economic calendar. There are very few successful forex traders but if you have the skill and discipline, Forex can probably be one of the most lucrative forms of trading. See how you can get inspired by these Top Forex traders.

- Trackers (ETF) are a great way to get started. They allow you to invest in a basket of assets, thereby spreading the risk. You can even choose a sector you believe in. They are low-cost (with fees as low as 0,05%), tax friendly, and available with many brokers or robo-advisors (more on that below). Check out item 12. in this article about stock trading, it covers Passive Investing with ETFs.

- Options and Futures: as a beginner, I would definitely not venture in derivatives straight away. But if you’re willing to put in the effort, to educate yourself, or if you’re already a seasoned trader then options can be very rewarding. Trading derivates is the most leveraged form of investing, and there are so many option strategies available. I’ll guide you to a number of them.

- Go for Cryptocurencies only if you are in one of two cases :

- a) if you are convinced that cryptos and blockchain will change the world forever and you are willing to take a long term bet on them (see my Long Term Bitcoin Strategy). You will be called a HODLER in crypto jargon.

- b) if you’re a seasoned scalper and you want to trade the crypto’s huge volatility.

There’s an interesting article at Lendedu.com on How to Start Investing. It can help you take your first steps as an investor, have a look at it.

Now let’s take a look at some statistics to see what are the odds of you becoming a successful trader.

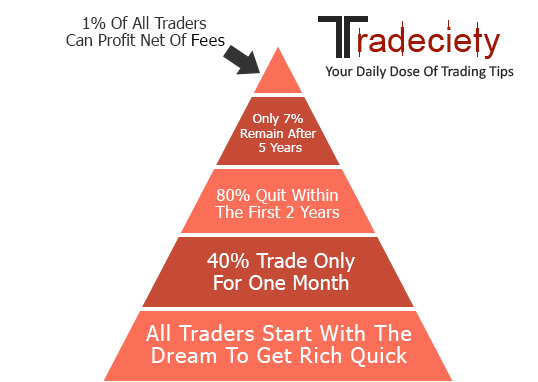

What are your chances of becoming a successful trader?

Common wisdom says that 90 to 95% of all traders fail. But there is no scientific evidence to that, so it is kind of a popular estimate. That was until a European regulation came into effect mid 2018, requiring brokers to display on their marketing material what percentage of their clients lost money.

And here are the brokers with the most extreme scores:

- eToro : with 75% of losing accounts, eToro came out first. This is probably due to their CopyTrader technology or social trading functionalIties enabling traders to exchange ideas or even replicate leading traders’ performance.

- FXTM came out last with 89% of losing accounts, probably holding a base of mostly unexperienced traders;

More complete numbers are available here .

It is interesting to look at the reasons behind this low success rate. Tradeciety ran through a lot of broker data and came up with an interesting breakdown of the reasons why most traders fail :

All the stats can be found here.

Now that you have a better understanding of financial markets and how to choose a market to trade, let’s take a look at Robo-advisors. A semi passive form of investing that could get you started .

That’s all explained in Step 3.