Whether you want to generate passive income, try and quit your current job, save for retirement or just invest some idle capital, you need to start by educating yourself if you want to Learn Stock Trading.

There are many steps you can take, and very often you won’t know where to start. This guide is here to help you navigate the stock investing world.

It will show you where to start, give you lots of advice and point to some free online resources along with some more elaborate options.

Learning stock trading can feel overwhelming, but if you take it one step at a time it is quite accessible and could end up being very rewarding. So here are 20 ways you can learn stock trading.

1. Get started and learn the basics from free online resources

The good news is you don’t need to start spending money to get a basic knowledge of stocks and investing. Some wonderful free resources are available.

Start by reading these Stock Basics articles from Investopedia. They are very well written, simple to understand and will give you all the basic knowledge: what are stocks, the different types of stocks, how stocks trade, … and lots of other basic know-how on the markets.

2. Read the best trading books

Reading books is the second thing you should definitely consider. Books are a cheap, well structured and invaluable way to learn from the best. I’ve reviewed two series of books that you might find useful:

If I had to pick two, my personal favorites are Andrew Aziz’s « How to Day Trade for a Living » and Benjamin Graham’s « The Intelligent Investor ». Both these books are bestsellers of the investing world. Andrew Aziz has written one of the best day trading books around and Benjamin Graham is the founding father of Value Investing, hailed by Warren Buffet as the the greatest investment book of all times.

A third option could also be the real classic written by Edwin Lefevre « Reminiscences of a Stock Operator », one of the most iconic trading books ever.

3. Open an account with a online broker

Once you’ve started getting a basic knowledge of stocks and investing, opening an account is the logical next step. The first criteria to consider is the place where you live. A great online resource to select a broker is stockbrokers.com. It offers extremely thorough reviews of online brokers, by criteria (platform, tools, fees,…).

A few brokers if you live in the US

If you live in the US there are three brokers I particularly recommend:

- the first one is TD Ameritrade, with its acclaimed platform Thinkorswim

- the second is Interactive Brokers (the broker I use), an absolute powerhouse serving some of the world’s leading funds and investors

- Robinhood, an ultra low-cost option and relative newbie in the brokerage world, but extremely aggressive on tariffs and mobile friendly. I have written a Complete Robinhood review if you’re interested.

4. Discover your style of trading

Before you start buying your first stock, you have to make an important decision: what trading style will you adopt? Usually, this will be a factor of several things: your personality, the funds you have, your appetite for risk, your expected returns, your resistance to stress and the time you are willing to devote to trading.

But most of all, trading styles are usually defined by the length of time that trades are held for. Here’s a brief overview of your different options, there are mainly four broad trading styles:

Scalping

The most extreme form of trading, with trades that last from a few seconds to a few minutes. The idea is to accumulate micro-profits, until they add up to significant gains. It is definitely a stressful trading style, challenging and usually reserved to experienced traders. You need to be able to make split second decisions, without hesitation, and in a repeated manner. Scalping requires you to remain focused for long hours. I would not recommend it as a trading style for beginners, however if you want to give it a try, you can check out my complete Scalping Strategy Guide. This trading style is quite appropriate for impatient people;

Day Trading

Trades are held anywhere from a few minutes to a couple of hours. The main principle is that you hold no overnight position, so day trading is appropriate for people who want to avoid the stress of keeping open positions. Often presented as an easy way to get rich, a lot of day traders are severely impacted by the importance of transaction costs so if this is the style your elect be careful to choose a competitive broker with low spreads;

Swing Trading

Swing trades are usually held for several days, so this is a style for patient people, who can let a trade unfold over several days. This kind of trading requires larger stop losses, to become a swing trader you need to be able to manage trades that go into negative territory for some time. It is however one of the styles most recommended for aspiring traders;

Buy and Hold or Position Trading

This type of trading consists in holding stocks from a few days to several years. Usually position trades are taken based on fundamental analysis, contrary to “shorter” trading styles who rely quite a lot on technical analysis. You need to be very patient, to stick to your strategy and not be too influenced by general opinion or news events;

Whatever trading style you choose, remaining consistent and faithful to your system will be key. Too many traders will switch styles as soon as they face a losing streak, thinking it is not optimal for them. But it’s proven, constantly switching styles will take you nowhere and most probably deplete your account.

Other trading styles involve buying and selling specific types of stocks, such as Penny Stocks (stocks with very low dollar value). If you want to know more about this type of trading, check out Timothy Sykes’ website, he’s one of the well-known specialists.

5. Start trading with a demo account (also called paper trading)

Getting started on a Live account can be risky, especially if you‘re still learning, uneasy with order entry and trade management, or simply not decided on your trading style.

Thankfully, most brokers will give you the option to trade on a demo account. Such an account will never entirely put you in the psychological conditions of live trading, however they’re a great way to start getting a feel for markets, your platform and trading strategy.

If your broker doesn’t offer demo accounts, you can try to open one at TradingView.com, an amazing charting platform that also acts as a social network.

An alternative is the Metatrader 4 platform, also very popular, but mainly targeted at Forex or CFD traders.

6. Read articles on Stock Trading

Quite a vast amount of literature is regularly produced on stock trading, however regular articles stand out in terms of quality, usually from a few websites. Bloomberg is one of them, with daily articles and news on all types of assets in their Markets section. Google Finance and Yahoo Finance are also quality sources, so is investopedia.com. More specialized articles can be found on seekingalpha.com. Some of these sites will enable you to subscribe to RSS threads, providing you with a regular feed of their articles.

7. Buy an online trading course

Once you have given yourself a basic education around stocks, there is a possibility that you’ll want to take things a step further. Online courses can provide you more advanced techniques, and Udemy is a wonderful platform for that.

Some of the courses are very affordable (as low as $10.99) and can provide you very valuable tools and techniques. While choosing an online course, I recommend that you carefully read the reviews so that you choose the ones with an established reputation.

The Online Trading Academy (OTA) is another well-known provider of trading classes and courses, they have some fantastic trading material but some of the courses are priced on the higher side.

8. Test some free online strategies

Now that you have an idea of your trading style, you’ve opened a Demo or a Live account, you want to get going and start buying stocks. Well, you are going to need a strategy, ie a systematic way of entering the market and managing your trades.

A lot of strategies can be accessed for free at Tradingstrategyguides.com. You’ll have more than you need, however you won’t be able to completely judge which ones are successful and which ones are not. That’s the whole idea behind a demo account, you can test them out.

I also have an article for an Ichimoku Strategy that I’ve been using quite a lot, it is described for Forex but can be applied to mostly any asset and has given me a good success rate so far.

9. Use free Stock Chart Platforms and Screeners

A great way to find trade ideas and plan your trades, or just analyze the market, is to use some online charting platforms. The most powerful is definitely TradingView, I have written a complete Beginners Guide here. This HTML5 platform is fantastic and includes a Stock Screener and a host of powerful tools, I highly recommend it.

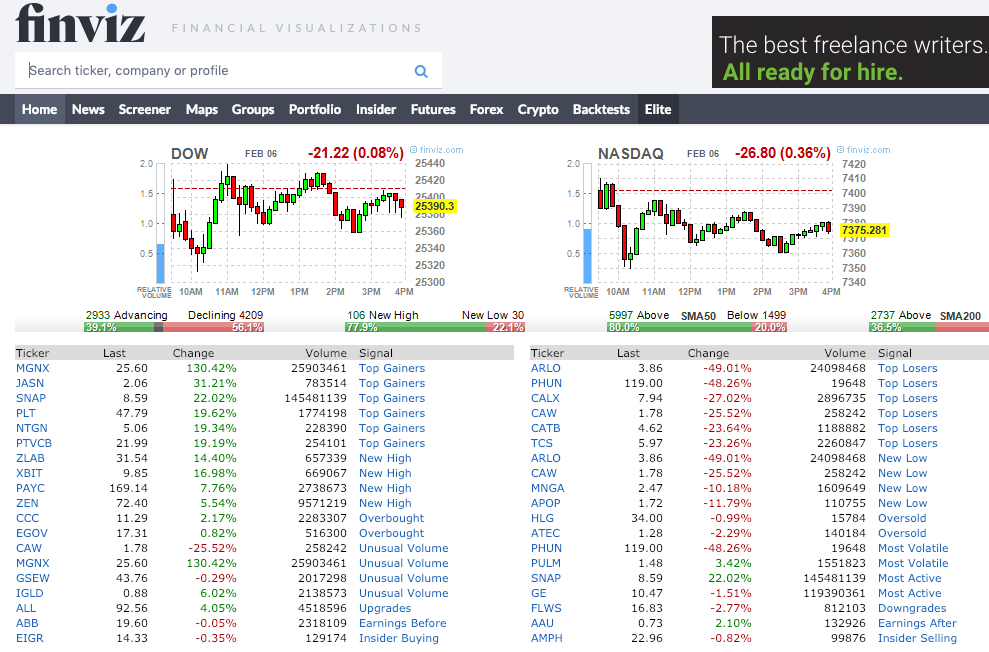

Another great option is Finviz.com, with its famous free stock screener, enabling you to search stocks with a near unlimited number of conditions and criteria. Lastly, you can also go with Stockcharts.com, a charting platform used by thousands of websites and expert traders.

10. Attend a trading seminar

Trading seminars are a great way to exchange first hand with top-notch traders or other like-minded investors. You can also get insights on things that are not that easy to convey in online courses: trading psychology, real life examples, track records.

For some people it really unlocks something in their trading performance and they refer to the seminar as the point in time when their trading took a leap forward.

Another important point is that a seminar creates a community, and that bond can tremendously help you in overcoming the inevitable difficulties you will face.

A few well-known seminars

Seminars are usually much more expensive than online courses, but they will give you the real life experience. Some well-known ones include:

- Dan Zanger: a trading legend famous for having turned $10,775 to over $18,000,000 in under 2 years; as an alternative, Dan also has a famous newsletter (The Zanger Report) edited via his website Chartpattern.com;

- Mark Minervini is another Wall Street veteran and famous trader. His seminar is called the Master Trader Program, it has good reviews and is definitely one of the references in terms of Trading seminars;

- Warrior Trading: Ross Cameron is an acclaimed trainer. He proposes a range of options, from online courses to Chat Room access or full-blown Trader Masterclasses. Worth checking out, his Trustpilot rankings are outstanding.

11. Emulate the greatest traders

Learning from the greatest traders is both inspiring and thought provoking. I have written an article on emulating the best Forex traders, but I suggest you also learn from some of the world’s most outstanding stock traders:

- Warren Buffett : the legendary Oracle of Omaha

- Ray Dalio : founder of Bridgewater Associates

- George Soros : the man who broke the Bank of England

- Jesse Livermore : the trader on which « Reminiscences of a Stock Operator » was based

- Ed Seykota : turned $5k into $15m in 12 years

- Richard Dennis : the man behind the fascinating « Turtle Traders » experiment

- Paul Tudor Jones : another legendary hedge fund wizard

A great way to learn more about these amazing traders is to read the Market Wizards series of books written by Jack D. Schwager, they are a great way to learn about their approach, psychology, and sometimes even the techniques and strategies that made them so successful.

12. Consider passive investing with ETFs

Warren Buffett made a famous $1m bet in 2007 against Protégé Partners that a simple low-cost S&P Index fund would outperform a basket of five funds of Hedge Funds over a 10 year period. He won, and you can read the story here.

ETFs, or Exchange-Traded Funds are marketable securities that track a stock index, a commodity, bonds, or a basket of assets. They are usually low cost (compared to mutual funds) and many successful investors have come to recommend them quite strongly.

John Bogle, the ETF authority

For an insight on ETFs you can read John C. Bogle’s (founder of Vanguard Group) « Little Book of Common Sense Investing ».

His eight core principles for index fund investing are:

- Select low-cost funds

- Consider carefully the added costs of advice

- Do not overrate past fund performance

- Use past performance to determine consistency and risk

- Beware of stars (as in, star mutual fund managers)

- Beware of asset size

- Don’t own too many funds

- Buy your fund portfolio – and hold it

Two interesting sources to take your ETF investing one step further are also etfdb.com and Morningstar’s ETF Center.

13. Find some trade ideas using social trading

Exchanging trading ideas with other investors is a great way to break the isolation. A few platforms will allow you to do that. The first one is stocktwits.com, the equivalent of Twitter for traders. It’s a huge community totally focused on Trading and Investing. Here’s a list of people you could follow during the earnings season for example.

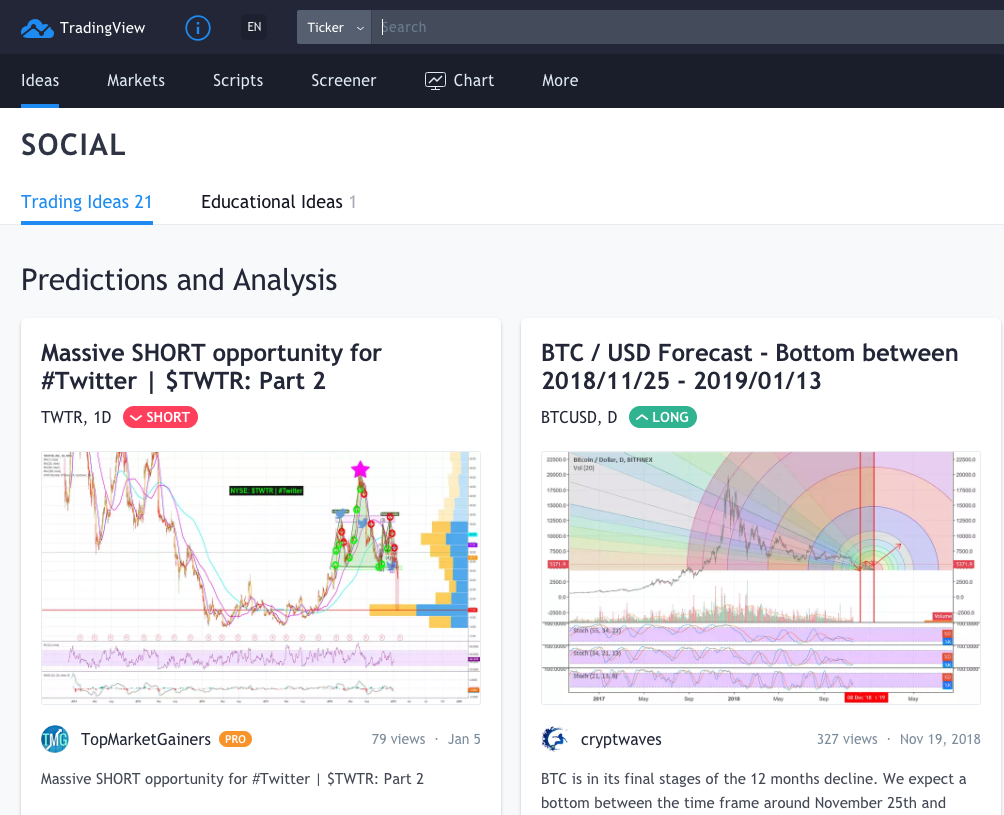

Another option is to use the social networking capabilities of TradingView. This tool is amazing, it integrates one of the most powerful charting platforms with social trading, screeners, and it even has broker integration for those who want to trade from the charts. Read my complete TradingView Beginners Guide here.

Lastly, there a brokers totally oriented towards social trading. eToro is the most well-known, allowing you to connect with other traders, discuss trading strategies and even use the CopyTrader technology to automatically copy the trading performance of the best traders.

14. Follow stock market news

Staying in tune with the market is important if you’re a day trader. Breaking news events on a stock can trigger big moves, so it’s likely you’ll need to stay put. The best known websites for market and stock news are bloomberg.com, google Finance, Yahoo Finance, or investing.com.

TV is another source of live info, with feeds such as the cnbc website for example.

More qualitative (and often subscription-based) sources could include and the excellent Wall Street Journal and Financial Times.

Lastly, if you’re looking for real-time market news feeds with Live economic announcements, just as you would get them on a professional trading floor then you can try Ransqawk, a live 24 hour real-time Voice and Text newsfeed.

15. Subscribe to online paid investment research services

Paying for research can be a good option if you’re out of ideas or don’t have the time to do the research. Some qualitative subscription services are available such as Investors Business Daily, created by William J. O’neil the founder of the CANSLIM model. You can also give Zacks a try or Morningstar, both very well-known stock advisory services.

16. Subscribe to investment newsletters

There’s a good number of newsletters available for stock pickers. They can provide you with lots of trade ideas. Here’s a list of some interesting ones, some free, some paid:

- Morning Brew : a free daily delivery of the top business stories

- Income Investor : published by Gordon Pape, recommended securities for an 8% yearly return

- Thoughts from the Frontline : written by John Mauldin, it is one of the most read weekly newsletters in the investing world, published weekly

17. Watch some stock trading tutorials and videos

There’s a great youtube video by William Ackman (renowned hedge fund manager) called “Everything You Need to Know About Finance and Investing in Under an Hour”. The title says it all, chances are you will learn a lot from it.

One of my favorites is also a speech delivered by Charlie Munger (Warren Buffett’s partner) at Harvard University in une 1995 called “The Psychology of Human Misjudgment”. Munger goes into the best-known cognitive biases that affect our judgement, in life in general but also as investors. I also have a full Infographic that summarizes these biases.

18. Find the best dividend stocks or learn dividend growth investing

Another form of passive income strategy is to buy dividend paying stocks.

This is a strategy quite similar to the buy and hold long term approach, except that you focus more on the regular cash flow from dividends than on the capital appreciation of your stocks. Investopedia has a series of introductory articles on dividends and dividend investing.

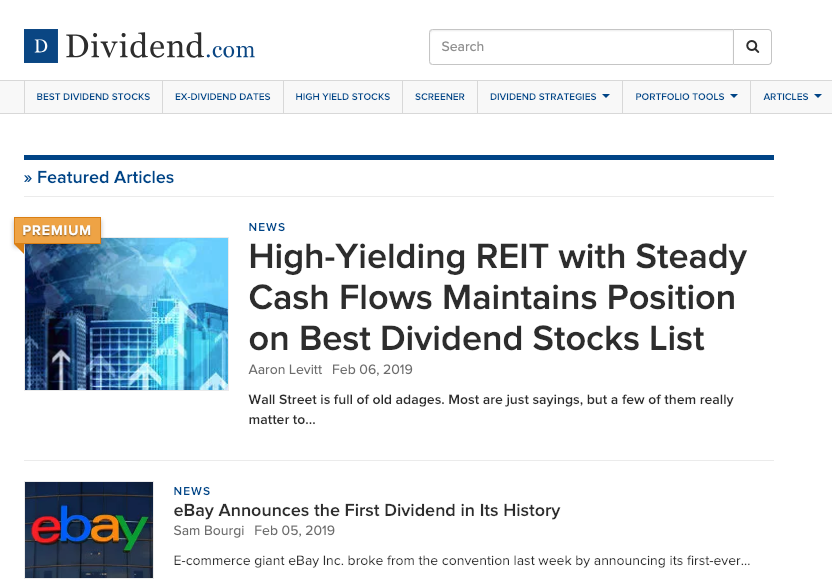

There are also some very good specialized websites for dividend investors, such as dividend.com, proposing a proprietary DARS rating to select and screen the best dividend stocks. I have tried it and can vouch for the quality of the selection.

Be careful with high yield

Important: selecting the highest yielding dividend stocks is not always the best option, because there is usually a reason behind the high yield. Either the asset is risky and performance is known to be volatile, or the stock has suffered a severe downturn.

In any case, be very careful with your stock picking. A much better option is usually to go for stocks with a track record of regular dividend growth. You can check out this strategy from Seekingalpha or try the very useful website simplysafedividends.com.

19. Consider contrarian strategies

As the name implies, contrarian strategies go against the common trends, they take the opposite view of market directions. Contrarians sell the assets that others are buying, or the opposite. They are focused on profit, not on what people think or what the market says.

David Dreman wrote a book considered to be the reference on this style of investment called “Contrarian Investment Strategies”.

Famous contrarians

Some famous contrarian investors include Jim Rogers and George Soros, who co-created the Quantum Fund, or Marc Faber who timed an astonishing number of market reversals. This article lists a number of other interesting Contrarian Investors and looks at their performance.

Finally, I am a regular user of the Contrarian Outlook website, edited by Brett Owens, it has given me loads of high yielding opportunities and I highly recommend the free articles along with the monthly paid namesake newsletter, it is brilliant.

20. Take a riskier approach and learn options trading

Once you feel comfortable with stocks, you could want to take a more aggressive approach and turn to options trading.

Essentially, options allow (but don’t require) an investor to buy or sell an underlying asset at a predetermined price over a precise period of time. You will have two types of options, Call (buy) or Put (sell) options.

A lot of brokerages offer options, and you can read this Options Basic Tutorial if you want to know more about them. I also have an article reviewing the Best Options Trading books.

Benefits and risks with Options

The benefits of options are that they will require smaller amounts of capital than buying the stock outright and they can be used to hedge or protect an investor from a downside risk.

On the downside, you could end up exposed to unlimited losses if you’re not careful, you will also need to be able to manage the time decay factor and finally you’ll have to make sure margin requirements don’t build up too much in terms of trading costs.

All being said, good options traders are often among the most successful and mastering this asset class can put you in another league.

Conclusion

I’ve come to the end of this Beginner’s Guide to Stock Trading. I hope you found it useful, forgive me if it’s a bit long. Trading stocks can be hugely rewarding and I definitely recommend you to start step by step so that you build on a solid foundation.

If you have any specific question or would like to know more about any of these steps, please drop a question in the comment box below, I’ll be happy to elaborate or provide an answer.

Further reading

I hope this review will be helpful. If you want to thank me, buy me a coffee 😉

Cheers. You’re right it’s a lot to digest but just one step after the other

Well let me tell you I went the same path, and sure enough things are easier with stocks. Good luck with your trading and thanks for the comment

Thanks a lot for your encouragement

If you’re not in for the long run then you can also consider Real Estate investing. Check out the book by Robert Kiyosaki “Rich Dad Poor Dad”, lots of interesting insights.

When it comes to Brokers go with the leading ones, they are reliable and provide good execution. What you do have to watch is those that claim “commission free trading”, these brokers usually resort to what is called Payment for Order Flow, it’s explained in my recent post on Robinhood.

That’s probably a great idea if he’s already a stock trader. But keep in mind that’s it’s always a little bit risky to give your funds to someone close to you because you don’t want the relationship to be impacted if the markets go south. 🙂

Akshay, thanks for your kind comment. Stock trading operates in quite different ways depending on where you live. I would recommend you to start Investing in your own country (in your own currency), otherwise you’re taking onboard a Forex risk on top of the market risk.

Great. you can start with William Ackman’s video, it’s really very helpful.

Hi Karl, thanks for your comment, glad I can help

Thanks Stella, take it one step at a time, I hope you get there !

Hi Tommy, good luck on your learning process, I’m glad if the material can be useful to you. Safe Trading.

Hi John, My professional field is biomedicine but I always had concerns about learning about finances, investments, and values but I always put it off until recently I dared to try a demo account as you mention in Libertex.The mechanism in principle seems simple, but I realize that a lot of data and intuition are needed to obtain consistent benefits.That’s why the information you provide is, but it’s hard to learn everything at once. Therefore I saved your page in an on purpose folder to have it on hand as training material. Thanks!

Thanks John to share these links. some are new to me, as i am new stock trading, I really have a good fortune reading this article. It was well-written and contained sound, practical advice. In fact, I have really benefited from it. You pointed out several things that I will remember for years to come. I look forward to reading your next informative work. Thank you.

John

Thank you for introducing me to investopedia. Investors Business Daily is also a wonderful site. I think I have been reading for about an hour now. Very interested in the Trade Market. I am going to bookmark your site so I can come back and learn more. I just don’t have the money to invest now and really like the free information. Thanks again.

Thanks for sharing this wonderful article on stock trading. Though it is long but it’s worth reading. This is really gonna help me to be grounded in stick trading by the time I start. I will watch and read more videos and articles on stock trading as you have highlighted in your article. This will be helpful to all intending and current stock trader.

Awesome website. Very insightful and informative article. Who doesn’t need it? Everybody must know this information if you are somehow dealing with money.

In 20 ways you have nailed the Stock trading ways to learn. It is complete and really good supplemental resources are being suggested. Just 1 question pops up in my mind that, does stock market trading operate in similar ways all over the world or certain countries have different rules?

Thanks a lot for sharing this article.

Thank you John for this elaborate post, it was truly enlightening

I started an online business recently, and i’ve been thinking of ways to multiply the income i generate, you’ve just offered me a great option, .

And like you said,learning is important.

On a second thought, probably i should just give funds to my brother who is actually a stock trader?

As i read through, i thought of him and will be sharing this with him right away

Thanks for this article, newbies like me definitely do find this helpful. I heard and read that brokers sometimes do uses bot as technology is advancing. My question is how safe these bots are and the assurance of trusting the system? Your article is precise and week written, keep up the good works.

Thanks for these wonderful tips for being a successful stock trader though I finds it scary investing into stock because of the high level of risks involved in stock marketing. Every business has its own secret if thriving and success and so does it with stock also. I really need to understand stock market proper so I can easily know the way.

I must say a well done job to you for all the time you spend to get her all the write-up together

this article is informative and educative on how to learn stock trading as a beginner

to become a good stock trader as a beginner require a lot of work and consistent learning and been active both on social media and the market in other to study reaction to news on the market and so many other thing u mention. This post is going to be helpful to beginners

Thank you for this great post. For the past 4 years I have traded on forex. I wouldn’t say it is a success because it is very volatile and risky. I just quit last year but has not seen an alternative since. Stock trading seem to be more of the alternative. I am familiar with most of the tools and strategy you mentioned. Thank yiy

Hi there, I must commend your efforts in compiling all these long guidelines to starting stock trading, well the fact remains u have just helped a lot of newbie who wanna join Stock trading and are not certain of where and how to start, this article bes explain everything they need to be successful in the trading. Only if they will take their time to read it,