This guide may contain affiliate links, please read my disclosure for more info

Before you start trading you need to define your trading goals. That means you need to start with the end in mind.

Video : Step 1 – Define your Goals

Depending on how much money you have, on what purpose you have for trading and your time horizon, you will need to approach trading totally differently.

Assess your financial bagage

How much money will you allocate to trading?

That question is key, because getting started with $100 in your account isn’t exactly the same as starting with $10,000, or $100,000. Then depending on your goals, that will tell you the level of risk you are going to have to take.

Let’s me illustrate why this is key.

It’s all a factor of funds, goals and time horizon.

If you have $1,000 available and want to reach $100,000 in two years, that’s a 900% return per year, so you need to multiply your account by ten every year, pretty steep right ?

That is hardly a rate of return any normal trader can achieve, let alone consistently. But if that’s your real target, then you are going to have to take A LOT of risk. And you stand quite a reasonable chance to lose all your funds.

So you have to tune your expectations.

Retirement calculator

To help you set your goals, here’s a Retirement Calculator you can use to assess how much you’ll have saved by a certain age depending on your income and the time horizon.

Have realistic expectations

Let’s see how these things can map out in a simple way.

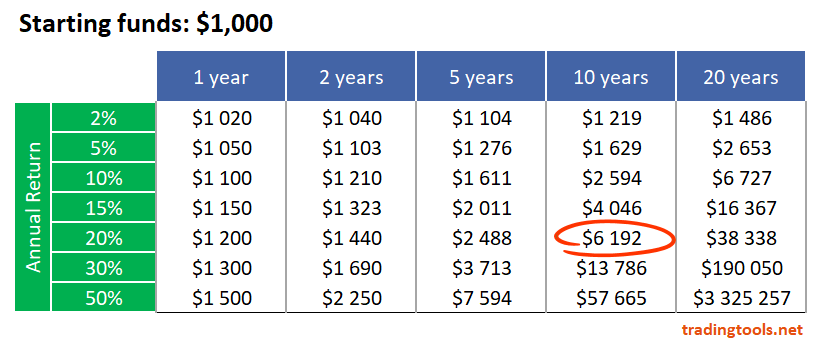

The tables below show you how much money you can make under three scenarios, with startup funds of:

- $1,000,

- $10,000,

- $100,000

In each scenario the table tells you how much you end up with depending on your annual return and time horizon (1, 2, 5, 10 or 20 years).

Scenario 1: how much will you earn if you start trading with $1,000 ?

Scenario 2: how much will you earn if you start trading with $10,000 ?

As you can see, if you want to cross the $1 million mark with $10,000 starting capital, you need to make between 20% to 30% a year for approximately 20 years.

Scenario 3: how much will you earn if you start trading with $100,000 ?

Obviously, starting with $100,000 is a much more comfortable situation, but you still need to make a decent return over at least 10 to 20 years to reach a million dollars.

These tables can help you set realistic expectations for your expected rate of return depending on your starting funds and your time horizon. It can also guide you to a type of trading (high leverage for example if you expect high returns).

Note : If you’re aiming for a rate of return consistently higher than 20% a year, be aware that very few traders achieve this kind of performance on the long run.

Another thing to keep in mind. You legally need $25,000 to day trade stocks in the US (this is called the PDT or Pattern Day Trader rule).

If you buy and sell a stock within the same day, your account will be flagged by your broker if it doesn’t have the minimum funding. Forex, on the other hand, does not require minimum funding, however I wouldn’t advise to start with less than $500.

Another thing, don’t forget that your funds will have to pay for the broker’s commissions. A lot of new online brokers advertise zero commission trading, but that’s not always the case, and don’t get fooled, there’s always a twist to that (as explained in this post on Robinhood).

What is your purpose for trading?

Before you start trading, you have to be clear on your intent, otherwise you’ll get mixed up. If you just want a side income to complement your monthly salary, that means two things:

- You should not gamble that monthly salary, but you can use a part of it to trade. Maybe you also have some savings on the side;

- On the other hand, the bright side it that you’re not depending entirely on trading to pay your bills, so that lifts a bi tof pressure on your expected returns.

It is much safer to start by trading a share of your monthly income than to decide from the outset that you’re going to quit your job and make a living out of trading. Take it step by step, and maybe if you’re successful and consistent you might achieve that dream.

There are some great books on Day Trading that will help you define your goals and give you an idea of what it takes.

I definitely recommend checking out these top recommendations. You can start with Andrew Aziz’s « How to Day Trade for a Living ».

If however you’re looking to save funds for retirement and are ready to be a long term value investor, like Warren Buffett for example, then you have to adopt a specific strategy. And definitely the book I recommend if this is the path you want to follow is every value investor’s bible, The Intelligent Investor, by Benjamin Graham.

So start by defining your purpose.

Your time horizon will define your trading style

A crucial part of defining your goals and strategies in trading is defining your time horizon. This will guide you to a specific trading style.

Here are the most common trading styles:

- Investing: usually long to very long term, holding positions (usually stocks) anywhere from a couple of years to 50 years or more. This is for traders who either have a large capital that can provide regular earnings or for those who are ready to give their investments time to mature. In the long run these strategies have always proven very successful if done right, but it requires sitting on your hands most of time, leveraging the famous power of the Snowball Effect.

- Swing Trading: holding positions over several days, weeks, maybe a few years. Quite compatible with a day job for example;

- Day Trading: positions are entered and exited daily. The day trader has no open position at the daily market close. Nearly impossible if you have a day job;

- Scalping: very short term trading, positions last a few seconds or minutes maximum. Scalping requires a lot of screen time, it is incompatible with a day job.

Usually a scalper will use very volatile assets, because he needs to profit from very short swings in the asset. Investors on the other hand will be much more interested in the long term fundamental value of an asset. These are two radically different approaches to the market, so you need to think carefully about this.

Another factor is the time your are willing to dedicate to trading. If you have a day job and cannot spend too much time on your screen, it’s going to be difficult to scalp or day trade. You might opt for swing trading or investing instead.

The all-mighty snowball effect, or the Importance of compounding

Compounded interest is one of the most powerful forces driving your financial returns over time.

Basically, compounded interest is interest over interest. Let me take an example:

If you earn 10% on a $100 deposit, in year 1 you will earn $10. But if you reinject these $10 in your capital then in year 2 you are earning $11. Interest will apply on a higher capital. This is what we call the snowball effect.

It is a hugely powerful force. Albert Einstein called it « the eight wonder of the world » and Warren Buffett made a fortune out of it. Inc.com made an interesting article around that.

Use the free compound interest calculator

The calculator below can help you calculate how much interest builds up over time from given sum and defines interest :

Compound interest is something that is hardly taught in schools.

If you start saving and investing while you’re young, you can make a huge difference in your life thanks to compounded interest. Here are some ideas to start investing before you’re 30.

Now that you have a clearer idea of how to define your goals, you need to choose a market to trade. I’ll help you make that choice in Step 2.