Copy trading can be an extremely lucrative strategy

The ever-evolving world of cryptocurrency can feel like a rollercoaster ride.

New coins emerge daily, established projects fluctuate wildly, and staying ahead of the curve can seem impossible. But fear not, fellow crypto enthusiast!

There’s a secret weapon in your arsenal that can give you valuable insights into the market: following the trades of successful crypto whales.

This article delves into the world of Arkham Intelligence (https://www.arkhamintelligence.com/), a powerful platform that allows you to peek behind the curtain and see what some of the biggest crypto players are buying and selling.

We’ll explore how this information can be a game-changer for your own crypto trading journey, all with a friendly and informative approach.

Why Follow the Whales?

Imagine having a direct line into the minds of some of the most successful crypto investors in the world.

That’s essentially what you get by following their on-chain activity through Arkham.

These “whales,” as they’re known, hold significant amounts of cryptocurrency and their decisions can have a ripple effect on the market.

Here’s the logic: whales have access to information, resources, and analytical tools that most retail investors don’t.

They spend a significant amount of time researching projects, analyzing trends, and understanding market sentiment.

By tracking their movements, you can potentially glean valuable insights into which coins they believe have strong potential.

Now, this doesn’t mean blindly copying every whale move. Remember, even the best investors make mistakes. However, by understanding their activity, you can add another layer of information to your own research process.

Unveiling the On-Chain Activity with Arkham

Arkham Intelligence is a blockchain data analysis platform that provides a unique lens into the world of decentralized finance (DeFi).

While it can get quite technical, the core idea is simple: it tracks the movement of cryptocurrencies across various blockchains.

This allows you to see not just price movements, but also the actual flow of funds into and out of specific wallets.

Here’s where the “whale watching” magic happens. Arkham allows you to identify wallets associated with prominent crypto investors and exchanges. By tracking their transactions, you can potentially see:

- New Coin Purchases: If a whale is investing heavily in a particular coin, it could signal their belief in its future potential.

- Increased Activity Around a Specific Project: A sudden influx of funds into a DeFi protocol used by a whale might indicate an upcoming project launch or exciting new features.

- Selling Activity: While not always a bad sign, seeing a whale sell off a significant amount of a particular coin could be a red flag, prompting you to do your own research.

Important Considerations Before You Dive In

While peeking into the wallets of crypto whales can be insightful, it’s crucial to approach this strategy with a healthy dose of caution.

Here are some key points to remember:

- Whales Can Be Wrong: Even the most successful investors make bad calls. Don’t blindly follow every move – use their activity as a starting point for your own research.

- Timing is Everything: Whales often move large amounts of capital, which can cause price fluctuations. Be mindful of the entry and exit points for your own trades.

- Do Your Own Research (DYOR): Never base your investment decisions solely on someone else’s activity. Always conduct your own research on the project, understand the technology behind it, and consider its long-term potential.

- Beware of FOMO (Fear Of Missing Out): Seeing whales invest in a project can trigger FOMO, leading to impulsive decisions. Take a breath, research the project, and decide if it aligns with your investment goals.

Making the Most of Arkham for Your Crypto Journey

So, how can you leverage Arkham’s insights to enhance your crypto trading experience? Here are some practical tips:

- Identify Whales to Follow: Research prominent crypto investors and exchanges. Many have a public online presence and discuss their investment strategies.

- Focus on Consistent Activity: Look for whales who consistently invest in projects with strong fundamentals and growth potential.

- Combine On-Chain Data with Other Resources: Don’t rely solely on Arkham. Use it alongside technical analysis, market news, and your own understanding of the project.

- Start Small and Scale Up: As you gain experience following whale activity, you can gradually increase the size of your investments.

Remember, following crypto whales isn’t a guaranteed path to riches. However, by using Arkham Intelligence strategically and conducting thorough research, you can gain valuable insights into the market and potentially make informed investment decisions. The world of cryptocurrency is exciting and ever-evolving. With the right tools

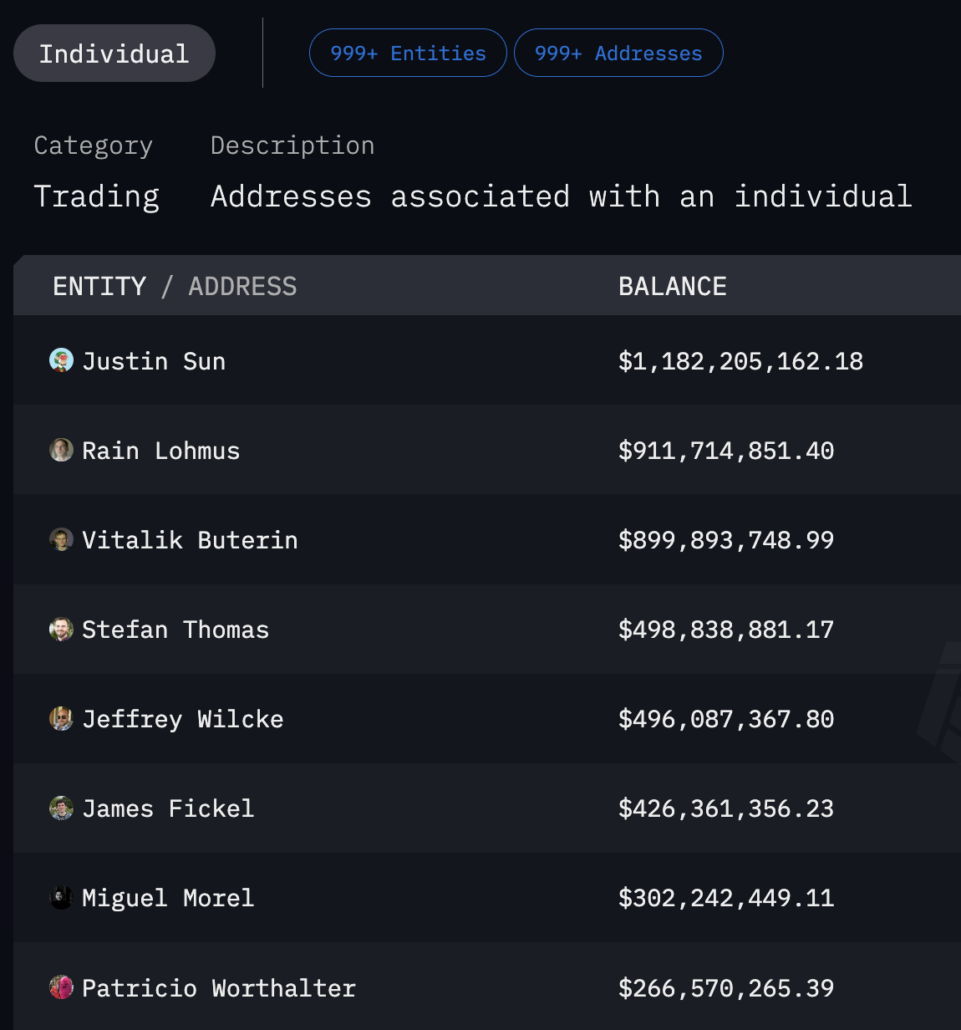

Examples of whales to follow

Since blockchains are public, it’s pretty easy to identify the wallets of famous people.

Here are a couple of famous traders or developers you can follow :

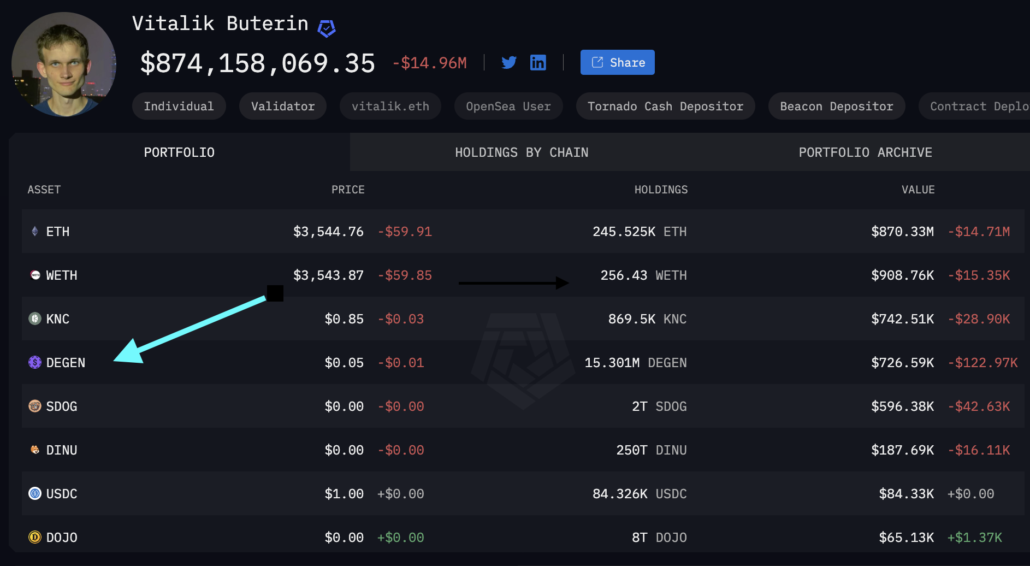

- Vitalik Buterin: https://platform.arkhamintelligence.com/explorer/entity/vitalik-buterin

- Gigantic Rebirth (GCR): https://platform.arkhamintelligence.com/explorer/entity/giganticrebirth

Further reading

- Follow Crypto Traders on Arkham and Profit from Their Trades

- Level Up Your Trading with TradingView Paper Trading

- How to Trade Linda Raschke’s Turtle Soup Strategy (Step-by-Step)

- The Wildest Bitcoin Predictions Made Some Years Ago Now Make Sense

- Unlock Profits: 5 Easy TradingView Strategies You Can Master Today