Managing your crypto taxes is a real hassle. The calculation rules, the forms you have to fill out. If you’re a regular trader this can prove a huge hassle. Especially if you trade on several exchanges, or if you trade on margin.

Luckily, there are a number of great tools out there that take the hassle out of crypto taxes.

Some of these website also provide dashboarding features and provide you with a consolidated view of all your holdings and their performance. All you need to do is plug in a few APIs and your performance updates automatically.

Most of the software reviewed below will provide you with automatic tax documents for the main countries: USA, Canada, Australia, India, UK, Germany, France, and many more.

Koinly is definitely one of the better ones, here’s why.

As the cryptocurrency market continues to evolve, keeping track of transactions and calculating tax liabilities has become increasingly challenging for investors.

Koinly addresses these challenges by offering a robust set of features that automate and streamline the crypto tax reporting process.

(Disclaimer : some of the links below are affiliate links, I only promote services I use and Koinly is one of them).

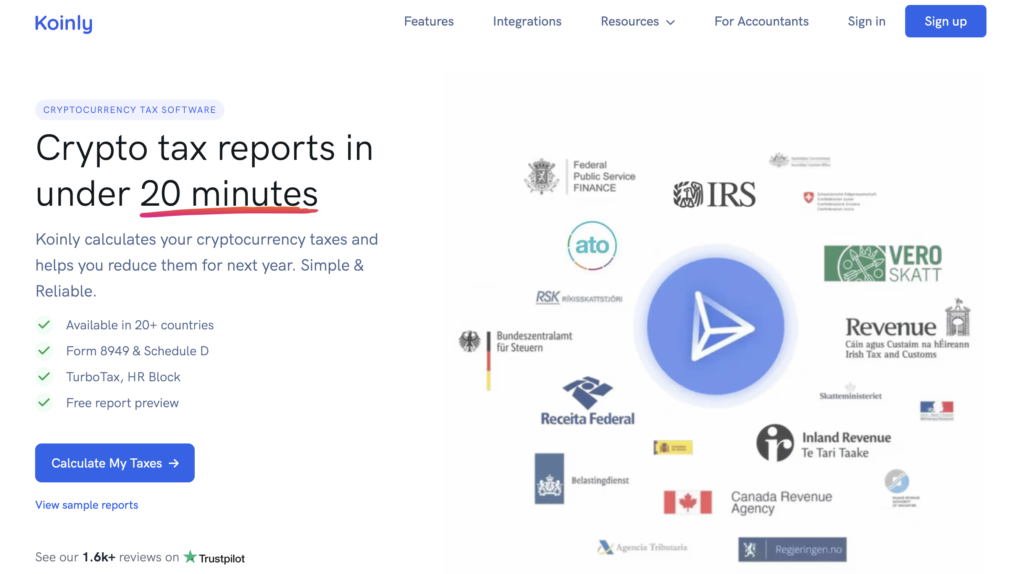

Koinly is a comprehensive cryptocurrency tax software designed to simplify the complex process of managing and reporting crypto taxes.

Key Features and Functionalities of Koinly

Automated Transaction Tracking

One of Koinly’s standout features is its ability to automatically import and organize cryptocurrency transactions.

The software integrates with over 400 exchanges, wallets, and services, allowing you to effortlessly sync their data.

This automation saves users significant time and effort, eliminating the need for manual data entry and reducing the risk of errors.

Wide-ranging Cryptocurrency Support

Koinly boasts support for an impressive array of cryptocurrencies and blockchain networks.

The platform can handle transactions involving over 25,000 cryptocurrencies across 220+ blockchains.

This extensive coverage ensures that you can accurately track and report on even the most obscure altcoins in their portfolio.

Portfolio Tracking

Beyond tax reporting, Koinly serves as a valuable portfolio tracking tool.

You can view yourtotal holdings, portfolio growth over time, and performance across multiple platforms.

This feature is particularly useful for investors with assets spread across various wallets and exchanges, as it provides a consolidated view of their entire crypto portfolio.

Tax Report Generation

Koinly’s primary function is to generate accurate and compliant tax reports.

The software offers a range of report options tailored to different countries and tax jurisdictions.

For U.S. users, Koinly can produce pre-filled IRS Form 8949 and Schedule D2.

The platform also supports tax reports for other countries, including the UK, Canada, and Australia, among others.

Integration with Tax Filing Software

To further streamline the tax filing process, Koinly allows you to export your crypto transaction data to popular tax filing software such as TurboTax, TaxAct, and H&R Block.

This integration ensures a seamless transition from crypto tax calculation to overall tax return preparation.

Smart Transfer Matching

Koinly employs artificial intelligence to detect transfers between your own wallets and excludes these transactions from tax reports.

This smart feature helps prevent the misclassification of internal transfers as taxable events, ensuring more accurate tax calculations.

Support for Various Crypto Activities

The software is capable of handling a wide range of crypto-related activities, including trading, mining, staking, lending, and DeFi transactions.

Koinly automatically tags income from various sources, such as interest from lending platforms or rewards from staking, making it easier to categorize different types of crypto income.

Data Import Flexibility

While Koinly offers automatic syncing via API for many platforms, it also provides alternative import methods for situations where API access is not available.

You can upload CSV files or manually add transactions when necessary.

This flexibility ensures that all crypto activities can be accounted for, regardless of the source.

Error Detection and Debugging Tools

Koinly includes several features to help users identify and resolve issues with your transaction data. The software uses a double-entry ledger system, making it easy to track and debug discrepancies.

It also highlights errors due to missing or incorrectly imported transactions and can detect and handle duplicate entries automatically.

Tax Loss Harvesting

For users looking to optimize their tax position, Koinly offers automatic tax loss harvesting capabilities.

The software can identify opportunities to use capital losses to offset capital gains, potentially reducing overall tax liability1.

Margin and Futures Trading Support

Koinly can handle complex trading scenarios, including margin and futures trading on supported exchanges.

This advanced feature ensures that even sophisticated crypto traders can accurately calculate their tax obligations.

Historical Price Data

To ensure accurate cost basis calculations, Koinly maintains historical price data for cryptocurrencies and fiat currencies going back over 11 years.

This comprehensive price database helps in determining the fair market value of crypto assets at the time of transactions.

Koinly Pricing and Subscriptions

Koinly offers a range of pricing plans to cater to different user needs, from casual investors to professional traders. The platform provides one free plan and three paid subscription options123:

- Free Plan: $0/year

- Includes portfolio tracking, capital gains preview, and support for up to 10,000 transactions

- Offers basic features like DeFi and margin trade support

- Newbie Plan: $49/year

- Includes 100 transactions

- Provides Form 8949, Schedule D, and international tax reports

- Offers export options to TurboTax and TaxACT

- Hodler Plan: $99/year

- Supports up to 1,000 transactions

- Includes all features from the Newbie plan

- Trader Plan: $179/year

- Supports up to 3,000 transactions

- Includes all features from previous plans

- Offers expert email support

For users requiring more than 3,000 transactions, Koinly offers an option to process over 10,000 transactions for $279/year.

All paid plans are billed annually and include features such as automatic import, real-time tracking, tax reports, and portfolio tracking.

The pricing structure is designed to accommodate a wide range of users, from beginners to experienced crypto traders, ensuring that users only pay for the features and transaction volume they need.

Conclusion

Koinly stands out as a powerful and user-friendly solution for cryptocurrency tax management and portfolio tracking.

Its combination of automated data import, extensive cryptocurrency support, and advanced tax calculation features make it an invaluable tool for crypto investors, from casual traders to seasoned professionals.

By simplifying the complex task of crypto tax reporting, Koinly allows users to focus on their investment strategies while ensuring compliance with tax regulations.

As the cryptocurrency market continues to grow and evolve, tools like Koinly will become increasingly essential for navigating the intricate landscape of crypto taxation.

Here’s a video I made around crypto tax software, proposing alternatives to Koinly if you’re intesrted.

Further reading

- How to Trade the OWL System from Gil Morales and Chris Kacher (A step-by-step guide)

- Larry Connor’s 2-period RSI Strategy

- What is a Gamma Squeeze in the Stock Market?

- Unboxing Success: A Comprehensive Guide to Trading with the Nicolas Darvas Box Method

- Koinly, the Top Crypto Tax Software: make taxes easy!