A Trading Strategy that has Proved Consistent for me

Are you looking for a simple 15min per day Ichimoku Trading Strategy? I’m going to share with you my simplified Ichimoku trading strategy. A system that has been quite successful for me over time.

It is inspired by Vince Vora, a trader that’s part of the team at Tradingwins.com.

I have used the basics of his system and customized it to add a few features. That way I’ve made it more precise and useful to me.

The system relies mostly on the Ichimoku Kinko Hyo system. But it’s stripped down version of it and has a few add-ons.

It is a simple system based on a few indicators that will tell you in a second whether you have a trade setup or not.

It can be traded with an extremely low risk level, I personally use a 1,5% risk on individual trades.

I’m assuming here that you are already familiar with Forex and Forex trading. I will not teach you to trade Forex.

If you’re a beginner and need advice on how to start trading, you can read my Definitive Guide on How to Start Trading.

Now, let me take you through the characteristics of this system, which is basically a momentum catching Ichimoku strategy.

To trade this strategy easily, I recommend you setup your charts on the free trading platform at TradingView, by far the best charting platform.

Which market for this Ichimoku strategy ?

This system works on any market, any timeframe. I use it to trade forex on the H4.

Due to my day job, I can’t afford to watch the market more than twice a day. Once early in the morning (around 7-8 AM GMT) and in the evenings (around 9-10 PM GMT).

For that kind of trading, the H4 is ideal. It will give you a reasonable volume of trades and a good grip on the momentum moves without forcing you to keep a constant eye on your trades.

What market conditions are we looking for ?

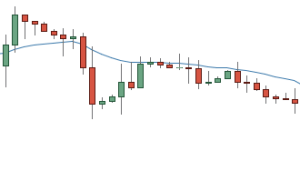

Since this strategy aims at catching trending moves, we are looking for clean charts. We want to avoid cluttered pairs where volatility is high with unclear price directions, violent swings or spikes, …

Two examples of what I mean below:

Clean chart, clear trend

Cluttered chart, high volatility, spikes, swings

What indicators will you need ?

The system uses five indicators. That might seem like a lot, but they all have a purpose. In fact, they are a tremendous visual aid for reading graphs and to me they make things much simpler.

The Ichimoku cloud and Kijun Sen

The Ichimoku Kinko Hyo system is a very elaborate but simple system. It was devised by a Japanese journalist named Goichi Hosoda in the late 1930s. He released it to the general public in the late 1960s after 30 years of testing and improvement.

It is a very complete system giving an instant view of market conditions. The system provides entries, exits, support and resistance levels and key past and future market levels.

Literally, Ichimoku Kinko Hyo translates as “one glance equilibrium chart”.

The original system consists of five lines named Tenkan-Sen, Kijun-Sen, Senkou Span A, Senkou Span B and the Chikou Span. The Ichimoku cloud is the area between the Senkou Span A and Senkou Span B, it is usually coloured.

Below is a representation of the system and the five lines that compose it (we only use three of them):

The Ichimoku system is a moving average based trade identification system. It is quite elaborate and novice traders might find it difficult to read.

However, in our trading system we are only using two of the core components. The Kumo cloud and the Kijun Sen. Why these two ? Because the information they provide is sufficient for the kind of market conditions we want to identify.

The Kumo cloud is the area between Senkou Span A (SSA) and Senkou Span B (SSB). Here are the formulas :

- SSA = (Tenkan Sen + Kijun Sen) / 2 plotted 26 periods ahead

- SSB = (highest high + lowest low) / 2 calculated over the past 52 periods and plotted 26 periods ahead

The Kijun Sen

The kijun Sen is defined as:

- Kijun Sen = (highest high + lowest low) / 2 for the past 26 periods

And for reference only (because we do not use them) the other lines are defined as:

- Tenkan Sen = (highest high + lowest low) / 2 for the last 9 periods

- Chikou Span = today’s closing price projected 26 periods back on the graph

What will the Ichimoku indicator tell us?

Basically, what the cloud and Kijun Sen will tell us is the following:

- Kumo Cloud: when price is above the cloud we have an uptrend (we only trade long). When it is below the cloud we have a downtrend (we only trade short). And when price is inside the cloud we have a neutral situation (no trade). The projected portion of the cloud can also be used as an indication of future market conditions. The height of the cloud is a representation of volatility. So a thinner cloud would indicate lower volatility, and a thicker cloud will represent stronger areas of support and resistance. The SSB is the stronger of the two lines and will generally form solid S/R levels. Markets are said to be bullish when SSA is above SSB, and bearish when SSA is below SSB. A crossing of SSA and SSB lines (usually triggering a change in the cloud color) is called a Kumo twist. It can be a sign of potential trend inversion.

- Kijun Sen: this line is used as a confirmation line and can be used as support or resistance. It is one the system’s stronger lines and usually a good indicator of future price movement. Its slope is particularly important. We use it both as a confirmation of the trend and as a potential trigger for exits being a representation of significant support or resistance lines.

A 21 period Exponential Moving Average (21 EMA)

Moving averages are the single most used indicator in trading. However, they do not predict future price movement, they just represent the current direction of a trend.

There are many different forms of moving averages: simple (SMA), exponential (EMA), weighted (WMA) …). In this case, we use the 21 period EMA.

Exponential moving averages reduce the lag by giving more weight to recent prices. That’s why I prefer it to SMA. It also tends to be one of the most widely used moving averages. So it’s a kind of a self-fulfilling prophecy. A lot of traders are always going to react around it.

In this system, the 21 EMA is used to confirm a trend. I’ll be looking for strong slopes as indicators of strong up or down trends.

Good slope

Weak slope (no trade)

The RSI set to 7 periods

The RSI is the Relative Strength Index. It was created by Welles Wilder in 1978. It is an oscillator type indicator that moves up and down on a scale from 0 to 100. The RSI identifies the speed and change of price movements.

The formula to calculate the RSI is the following: RSI=100 – [100 / (1 + RS)] where RS is the Relative Strength = average gain / average loss

In the standard setting of the RSI, the average gains (loss) are calculated by adding all the gains (losses) for the past 14 periods.

I use it with a setting of 7 periods in order to trade quite a short cycle. Occasionally I will set the RSI to 4 periods if I want to make sure I detect an earlier signal. That might add a little risk but it’s fine.

The RSI has the following index thresholds:

- A reading of 30 or under is considered “oversold” and identifies potential price increase

- 70 or above is “overbought” and identifies a potential price decrease

- 50 is considered neutral, and crossing that mark is usually the indication that a trend is forming. In my system, I use the bounce on the 50 mark as a confirmation that a trend is resuming (see below)

Bill Williams Fractals

Fractals were developed by Bill Williams as part of a system that he created mixing the Chaos Theory with Human Psychology. Taken alone, fractals are indicators that actually break larger trends into smaller and simple reversal patterns. A fractal is composed of five or more bars, and there are two types of fractals:

- Up fractals: a bullish turning point occurs when there is a pattern with the lowest low in the middle and two higher lows on each side

- Down fractal: a bearish turning point occurs when there is a pattern with the highest high in the middle and two lower highs on each side

The fractals are turning points. I‘ll use them for stop loss placements (initial and trailing). In a long trade, I’ll place my stop at the most recent red fractal. In a short trade I’ll place my stop loss at the most recent green fractal (see further down stop placement).

What are the entry rules?

Now that I’ve gone over the indicators and timeframe, let’s take a look at the entry rules. Simple and easy to remember, they make the system very straightforward because 99% rule-based. A bit of trader discretion will always be necessary in any system:-)

The first thing you should do is check that no major market announcement is on the docket for the pair you’re trading. Rate announcements, central bank conference, macro-economic figures release, …). They’re all very important since they can bring uncontrolled volatility to the pair.

Long trade entry

For a long trade, the following conditions need to be met:

- price should be above the kumo cloud, indicating an uptrend (no trade if price is in the cloud or below);

- the 21 period EMA should have an upward slope (avoid flat) as illustrated previously. Ideally the Kijun Sen shouldn’t be in a flat position either. That would mean we’re not really making higher highs on a medium term perspective. There will however be some cases of entry when the Kijun is not yet sloping upwards; this will be a discretionary decision, the most important is the 21 EMA;

- the idea is to catch a swing low on the uptrend and enter when the trend resumes. To time your entry, use the RSI as a gauge of speed and momentum of price movement. You need it to dip towards the 50 mark and bounce back up again after hitting it. The signal candle will be the one where the RSI goes back up.

- enter on a break of the high of the signal candle.

Short trade entry

For a short trade, things should be the exact opposite:

- price should be below the cloud, indicating a downtrend (no trade if price is in the cloud or above);

- the 21 period EMA should have on a downward slope (avoid flat) as illustrated previously. Ideally the Kijun Sen shouldn’t be in a flat position either. That would mean we’re not really making lower lows on a medium term perspective;

- the idea is to catch a swing high on the downtrend and enter when the trend resumes. To time your entry, use the RSI as a gauge of speed and momentum of price movement. You need it to move towards the 50 mark and bounce down up again after hitting it. The signal candle will be the one where the RSI goes back up.

- enter on a break of the low of the signal candle

In both long and short entries, it could happen that the RSI doesn’t exactly hit the 50 mark. I think that can be ok if it remains in a reasonably tight zone around the 50 level. However all other conditions should be met, especially the slopes on EMA and Kijun. That is left to trader appreciation but I have found to miss significant market moves if I get too strict on an exact hit of the 50 mark.

Where should you put your stop-loss ?

For stop-loss placement I have already explained that I use fractals.

Again, it is a simple and straightforward rule. The reason for using fractals is that they represent key short term swing highs or lows.

If I’m going long and the previous up fractal (see above for definition) is broken by a downward move then my conditions for an uptrend are no longer met.

And the same goes for a short trade. If a down fractal is broken by an upward move then my conditions for a downtrend are no longer met.

How to manage your trade and where to exit?

I usually trail my stop to the next fractal. But since I try to keep my risk extremely low sometimes I’ll quickly move to break even if I’m up 1R let’s say.

For exits, this is very discretionary. Several options to choose from. You can exit:

- when price crosses the Kijun or EMA

- if price hits the cloud

- at a certain level of gain. This is what I use most often. I usually exit around R3 (3 times my risk). More precisely, when price is around R3 I’ll move my stop very close, leaving room for further gain.

All of this depends on your apetite for risk and the kind of R:R you are aiming for.

Risk management for this Ichimoku Strategy

I usually go with a 1,5% risk max on any given trade. That’s quite reasonable and I like to keep it that way. I’m fully comfortable with risking 1,5% of my capital on any given trade.

Experience has proven that keeping losses at a minimum is absolutely crucial.

So I try to NEVER break that rule. I try to aim for 3R usually, which means 3 times my risk level. For example, if I have a 20 pip stop loss I’ll aim for a 60 pips take profit.

What Forex Pairs can you trade with this Ichimoku Strategy?

Reading the market with this system is extremely simple. You only need a few seconds on each pair to know if you have a trade.

Here are the Forex pairs that I trade :

EUR/USD, GBP/USD, AUD/USD, USD/JPY, EUR/GBP, NZD/USD, EUR/JPY, XAG/USD, XAU/USD, GBP/JPY, EUR/AUD, GBP/AUD, USD/CAD, EUR/CAD, EUR/NZD, AUD/CAD, AUD/NZD, CAD/JPY => 18 pairs

All you need is 15min per day: trade with a day job

It really doesn’t take me more than five minutes in the morning and five minutes in the evening to scan the market.

You might need a little more time if you have open positions. But basically that’s it => this is a 15min max per day system. No interpretations and splitting hairs, you either have a setup or you don’t.

Well, there you have it. That’s my Simplified Ichimoku Strategy.

You can give it a go and give me your feedback. I’m sure this strategy can be improved, but so far it’s working for me so that’s all I need.

If you don’t have the time or the energy to implement this strategy, you can also find some good Ichimoku traders on some social trading sites (like eToro). I recommend trying their CopyTrading function. You can get some decent returns if you carefully select the best traders.

Safe trading to all.

One last thing, … a fantastic Ichimoku book

Among the many books written on Ichimoku, there is one I definitely recommend if you want to take things further.

It will provide you with a lot of very valuable strategies, on all time frames. It has been written by Karen Peloille, a french specialist who has taught tons of traders in banks and financial institutions worldwide.

She is very renowned, straight to the point and known to be one of the most consistent traders around.

Find her book here, enjoy your reading.

Download a PDF of My 15 Min per Day Ichimoku Strategy

As a bonus, you can download this post as a free 15min per Day Ichimoku Strategy PDF Guide.

If you want to thank me, you can buy me a beer.

I do not collect emails, will not spam you with unsolicited content, and you can download my PDF with no strings attached.

Also available as a video : My 15 Min per Day Ichimoku Strategy

Further reading

- How to Trade the OWL System from Gil Morales and Chris Kacher (A step-by-step guide)

- Larry Connor’s 2-period RSI Strategy

- What is a Gamma Squeeze in the Stock Market?

- Unboxing Success: A Comprehensive Guide to Trading with the Nicolas Darvas Box Method

- Koinly, the Top Crypto Tax Software: make taxes easy!

To me the best timeframe is the H4, but the system works well on Daily and Weekly. I haven’t tested on smaller timeframes though.

Which timeframe (daily or intraday)? Thanks.

Hello Susan,

In 2019 my day job has left me very little time to trade, I now own quite a large portfolio of dividend stocks on autopilot. Hopefully I can revert back to more active trading in the upcoming months. Concerning the above strategy, it was definitely very good in times of trending markets and quite challenging in ranging situations, so as always the Money Management would be the key.

Safe trading. John.

Hi Johan

i m begginer trader can you send me your strategy indicator setting in MT4 screen shot

i need help due my english not very well

Hi John

Great read and its nice to find a strategy that works i have been trading for 9 months and dropped across the cloud and found that i had a interest in it then dropped across your blog i will now be trying out your strategy on my demo account i trade oil and nat gas thank you for a great read and the information

Hello John,

I wonder to know if you could share your annual performance last year. Including your initial investing capital.

Regards,

Susan Yaz

Hi Adrian,

thanks for such a great comment. I’m so glad you find the system useful. Let us know how you’re doing with the system if you trade it live.

All the best.

John

Hi John,

Good Morning to you.

I just found your Ichimoku Strategy and yet found it is not just a simple and easy to use guide but also covered some of the basic functions of Ichimoku Indicators.

My name is Adrian Susianto. I am from Sidoarjo city in Indonesia. I am just a full time job person which passionate with stock and derivative trading. I have stock trading but derivative (forex) is what I am very fond of to continously learn it.

Back to several months ago, I just changed and developed my trading strategy using Ichimoku. My interest in Ichimoku started when reading blogpost from Rolf from Tradeciety and realized that this system / indicator has very high potential of analyzing the price. My strategy usually consist of several indicators combined to develop “moment market reading”. And I found it more simple to replace my system with Ichimoku.

My basic “template” always Triple Screen, adopted from Dr Alexander Elder. And Ichimoku is now consist in my third screen to make decision whether to open or to close position(s).

What you explained here is similar in what I was doing to analyze. I also already owned Karen Peloille’s book but honestly her book is deeply explain the ichimoku itself which I hardly to follow. It is a good book to develop Ichimoku system by understanding the deeply ground of Ichimoku, but I need more practical analysis.

So thank you so much for giving us more better and easier understanding of Ichimoku.

PS: I am glad to read that your are still active in this blog when saw your last reply were on February 2019. It means you are still active trader 😀

Hi Ola, great news. Good luck trying the system out, you can test it on demo. Thanks. John

Try it out on a demo account, you’ll see it’s a good system if you remained disciplined.

Glad it helps. Cheers.

Thanks a lot. I don’t actually offer mentoring because of lack of time, what I suggest is you read my article on 20 ways to Learn Stock Trading, it is going to give you a lot of tips and links to free resources that will help you in your journey. Good luck with your trading.

I don’t use Tradingwins, this strategy is an adaptation of one published by one of their traders in a free online webinar, making it my own. So I wouldn’t be able to give you an opinion on their service. My advice would be to open a Paper Trading account at an online broker and test the strategy before you take any further step. My article on 20 ways to learn stock trading can maybe help you on your journey.

Oscar, thank you for that. Actually my success rate is good, the difficult thing is to find the right market conditions, this system really works best when the asset is in trending mode. If in a range, you will struggle and then only an ultra tight money management can save you. That’s where long term strategies on stocks can be much easier to implement.

Thanks for the comment. You can actually trade mostly any market with this system (stocks, forex, commodities, indexes)

Thanks Anthony, I hope you find it useful and can profit from it. Cheers. John

Dear John,

Thanks for the informative article. I always want to make some money in the stock and Forex, since several of my close friends made a lot of money by trading stocks and Forex. When we meet, they always discuss the market and I thus learn something from them.

Now you introduce a solid system for people like me to follow and I bookmark your site and will come back to study more. It is so nice you have a complete system that track the market conditions, suggested entry point, exit point, support, and resistance levels. All these are closely monitored in association with past and future market level.

Like you , I have a full time job and the time you did research are perfect for me. So nice I am going to this chance to learn from you.

Regards

Anthony

The strategies you employed are actually unique in its own way. Anybody who have traded forex before should be able to use this. This reminds me of when I traded forex 10years ago. When I was looking for a legitimate way of earning money online. I traded with fxopen brokers. I lost all my money because my strategies weren’t good enough.

Hi John,

trading is definitely not everyone’s thing. I tried it for some time but I did not achieve success at all with it. I tried many different strategies, read a lot about it, but I was not able to make it. I do think it works, but it is definitely not for somebody who is in need for quick bucks, because you risk too much and you do not stay focused. You get too emotional. I think that was the problem back when I tried it. Although I did not lose much money, because I did not invest much, I think it was a clear note to me that it was nothing for me.

However, personal story aside. This model looks really good and straight-forward. You can tell that it has been tested extensively, which makes it even more reliable. If I should be going back into trading (which I still have in the back of my head), I will be sure to look more into this strategy and see what I can achieve.

As I looked at all those graphs, I can easily see what is meant, but it did not look that good when I did the trading. How has your success with this strategy been?

Thanks.,

Oscar

Thanks for putting this together. A am new to trading, so it’ll take some catching up for me to really get the most out of this strategy. The good thing is, that you give a lot of information to think about and consider.I’m going to check out your ‘Learn Trading’ article next. You mentioned Tradingwins; I assume that you use them. Are you doing well with them? What I really want to know, is it worth the $100 per month?

Hi there, thanks for dropping this article about ichimoku, your explanation and analysis will really help a lot of people into forex trading before now and wanna enhanced their understanding and knowledge about it. But in a case of a beginner like myself who’s just developing interest in forex, I have to take my time to read the book u shared about beginning forex before I can fully understand all this. Or perhaps u can help In mentoring

Nice article you post there. It so full of information and educative point in your trading strategy which you call My Ichimoku trading Strategy.i find it helpful because am still new in trading, and specifically I don’t have a trading strategy yet because am still getting all the information I can get on trading and also learning skills. I will look at all your recommendation and once again thanks

This is a very informative post I must say, I first heard the fancy catching term Ichimoku and I was tickled and I knew I wanted to hear more about this, then I heard that the Ichimoku comes from the Ichimoku Kinko Hyo, then I was wowed. Thee terms are so catchy that they draw my attention to every detail. Thanks to people like Vince Vora, the initiator, other people can get trading advice. Cheers.

This is a lovely and incredible post, i must tell you i learnt a lot from this secretive strategy you shared here. I have been a Forex trader before now but i couldn’t get the main strategy which made me burnt my account severally but reading your article today has exposed me to so many things and i can easily work out my past mistakes. Thanks for sharing,.