This guide may contain affiliate links, please read my disclosure for more info

If trading looks a bit overwhelming, there’s a first step you can take. Choosing a Robo-Advisor.

Video : Step 3 – Consider Robo Advisors

Robo-Advisors are essentially online portfolio managers.

They’re great if you’re comfortable with a hands off approach to trading and investing.

It can also be a way to dip your toe and get a feel for financial markets before you start trading.

So, let’s try and understand what are Robo-Advisors and how can you pick the best one for you.

What are Robo-Advisors?

New young startups are creating innovative and revolutionary ways to invest funds, they are called Robo-Advisors.

These essentially mobile platforms offer a fully digital experience. Their user-friendly interfaces help you save and invest money with minimum effort and cost.

It is now possible to get started investing in a matter of minutes and a few clicks. Costs are also a fraction of what old school wealth management firms used to charge.

When should you opt for a Robo-Advisor vs Trading?

First, keep in mind that Robo-Advisors do not provide financial planning but automated or semi-automated services.

So if you need a high degree of customization or advanced tax optimization they might not be the best choice.

If however, you are looking for low-cost, user friendly and reasonably passive services, Robo-advisors are the thing. In fact, you can’t really compare them to trading because as a trader you make the decisions, and risk reward ratios are accordingly totally different.

The 10 things to look at before choosing a Robo-Advisor

Robo-advisors fall under many categories, and new ones keep opening, so here are the 10 things I recommend you to look at before choosing:

- Minimum deposit requirement: could range from $0 to as much as $25,000

- Management Fees: usually between 0.15% and 0.5% of your assets annually

- Portfolio content: stocks, forex, mutual funds, fixed income, ETFs, cryptocurrencies,…

- Account types: taxable accounts, IRA (Individual Retirement Account)

- Goal setting functionalities: ability to set targets (save for retirement, retiring before a certain age,…)

- Tax loss harvesting capabilities

- Advisor or Broker-Dealer: very different from a regulatory perspective, Investment Advisors can provide targeted advice

- Socially Responsible Investing (SRI): is it available?

- Educational content: availability of tutorials, courses, advice

- Customer service: mode of access (mail, phone, chat), open on weekends?

The Top 5 Robo-Advisors for 2020

Here are my top 5 Robo-Advisors for 2020 and what makes them attractive:

Betterment: no minimum deposit, excellent service, goal setting functionalities, personalized projections, tax-loss harvesting, automatic re-balancing. When you sign-up, they will analyze your profile and goals and make personalized recommendations. Excellent mobile app, it will tell you exactly what mix of stocks, bonds or ETFs will be invested depending on the risk appetite and time horizon. Lastly, the Betterment Everyday service is a cash management suite that helps you make the most of everyday money. Clearly one of the industry leaders.

Wealthfront: offers a full range of services for hands off investors. It is one of the most highly regarded apps with its planning tools, automated portfolios and advanced tax optimization strategies. Wealthfront features low fees and a full range of services for hands-off investors, goal investing, even an interest-paying cash account. Account minimum is $500. Wealthfront is consistently rated among the top Robo-advisors by leading industry websites.

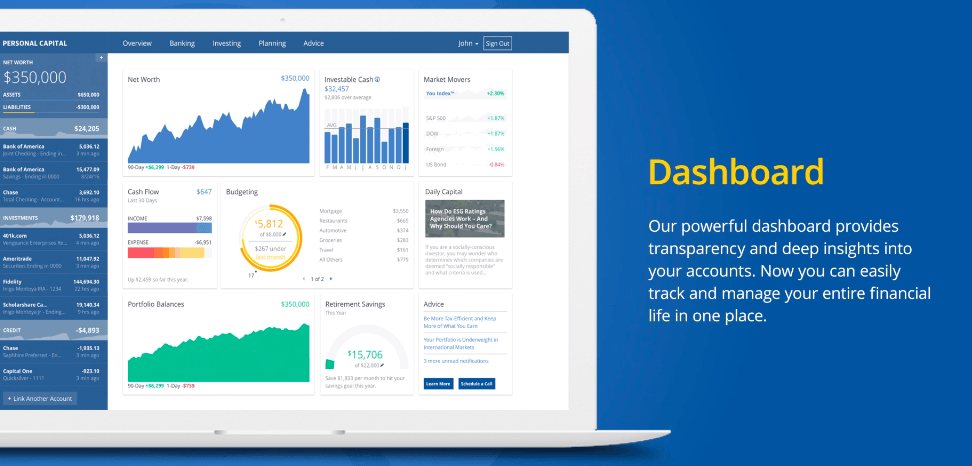

Personal Capital provides leading financial tools and advice for high net-worth customers. It boasts very advanced services, combining a robo-advisors with personalized advisory services. It is truly one of the best apps to track and manage your money, with award winning tools, it is quickly becoming a very significant player of the Wealth Management industry. Personal Capital is only open to US customers and targets $100,000 plus customers. You can use Personal Capital’s app for free to receive regular summaries of your spending, net worth, and investment portfolio.

Ellevest is an excellent service for goal-based investing, and it specifically targets women. It has been created under the principle that women have specific investment needs (longer lifespan or gender pay gap). No minimum investment is required. The service is perfect for newbies but allows investment in 21 different asset classes. As a fiduciary, Ellevest has an obligation to act in its client’s best interest. There are three types of accounts at Ellevest :

- Digital: personalized investment portfolio, Ellevest Impact Portfolios, Automatic deposits, Automatic rebalancing, unlimited support from Concierge Team

- Premium : Digital features + access to a certified financial planner and executive coaches

- Private Wealth Management: only for qualified clients, offering private wealth management with values-based investing options.

SoFi wants to help you get ahead of your financial life. Borrowing, saving, spending, or investing are all possible using SoFi. If you want a loan, a number of options are opened to you: student loan refinancing, medical resident refinancing, dental resident refinancing, mortgages, mortgages refinancing, personal loans and more.

Investing with SoFi comes with no fees, and you can go with either automated investing or active investing if you want to be more hands-on.

Like all of the companies featured above, SoFi is purely digital, which is why it can be aggressive on tariffs. SoFi definitely stands out for the quality of its educational material.

If you want a more in-depth review of the available robo-advisors, check out my article on The 15 best Robo-advisors.

Now if you decide that Robo-Advisors are not for you, and you want to push ahead with trading, let’s see how you can take the first essential step and learn trading.

That’s explained in Step 4.