We are coming to a crucial step here. You need to Learn Trading, and we’re going to do that in 12 easy steps.

But let’s be clear.

You can get the best educational background you want (trading books, seminars, courses,…), but until you are live in front of that screen with graphics pulled up and real funds ready to be traded, you will never know how good or ready you are.

So you need to learn trading fast.

The sum of psychological factors that go into trading activity (fear of losing, fear of pulling the trigger, revenge trading, excessive confidence, FOMO…) is just huge.

In fact, one of the most important bricks of your education as a trader should be around handling your emotions and learning to cope with losses.

There’s an interesting speech Charlie Munger gave at Harvard on The Psychology of Human Misjudgment.

It explores the tricks our mind plays on us, and a lot of them can be applied to trading.

Most of the educational material around trading usually covers psychology in quite some length. And trust me, this is THE most important thing that you will have to learn and master.

So, how can you learn Trading? Here are 12 easy tips.

Tip #1: Read the best trading and investing books

One of the best (and cheapest) ways to learn trading is by reading books. Make sure you select books written by well known traders, only they have the credibility to really teach you the tricks.

Depending on the type of trading you’ve decided to look into, I have a book selection for you to check out:

- The Top 10 Day Trading Books

- The Top 12 Investment Books for Beginners

- The Best Options Trading Books

- The Top Rated Personal Finance Books

Out of these book selections, my 4 favorite reads are clearly :

- How to Day Trade for a Living by Andrew Aziz

- How to Make Money in Stocks by William J. O’Neil

- The Little Book that Still Beats the Market by Joel Greenblatt

- Market Wizards by Jack D. Schwager

I would add a special mention to a book written by Karen Peloille, a famous French trader known for her mastery of the Ichimoku system, a Japanese system she trades very efficiently:

- Trading with Ichimoku by Karen Peloille

I am especially fond of the Ichimoku system and have traded it quite a lot, you can check out my Simple Ichimoku Trading Strategy

Lastly, I’ve always felt that Real Estate was a fabulous way to reinvest potential gains from trading once they got significant. Or maybe you have read the Great Book Rich Dad Poor Dad by Robert Kiyosaki, then you should be interested in this list of the Top 10 Books on Real Estate Investing.

Tip #2: Learn from free online resources

Here’s the good news, there’s a wealth of free education available.

If you want to learn Forex, start by reading this Beginner’s Guide to Forex Trading from Investopedia. It is extremely well written, simple to understand and covers all the basics : what is the Forex Market, Forex for Speculation, Why we can Trade Currencies, A Brief History of Forex, Currency as an Asset Class, Forex Trading Risks, and a host of other resources.

Another great free resource for Forex Trading is the « School of Pipsology » over at Babypips.com.

The course is 100% free, very detailed, extremely clear, definitely a place you could start from.

If you want to learn Stock trading, then turn to these these Stock Basics articles from Investopedia. They are very well written, simple to understand and will give you all the basic knowledge: what are stocks, the different types of stocks, how stocks trade, … and lots of other basic know-how on the markets.

Tip #3: Read free articles on trading

Quite a vast amount of literature is produced daily on stock trading, however regular articles stand out in terms of quality, usually from a few websites. Bloomberg is one of them, with daily articles and news on all types of assets in their Markets or Currencies section. Google Finance and Yahoo Finance are also quality sources, so is investopedia.com.

More specialized articles can be found on seekingalpha.com. Some of these sites will enable you to subscribe to RSS threads, providing you with a regular feed of their articles.

Concerning Forex market news, one of the leading websites for is dailyfx.com. It provides the latest info on world markets, facts that affect currencies and even analyst tips.

Forex news can also be found at fxstreet.com or forex.com.

Tip #4: Buy an online trading course

Once you have given yourself a basic education, there is a possibility that you’ll want to take things a step further. Online courses can provide you more advanced techniques, and Udemy is a wonderful platform for that.

Some of the courses are very affordable (as low as $10.99) and can provide you very valuable tools and techniques. While choosing an online course, I recommend that you carefully read the reviews so that you choose the ones with an established reputation.

Warrior Trading is another great provider of Trading Courses. It has a very high reputation, and provides courses for absolutely all types of traders (day traders, swing traders,…).

Tip #5: Attend a Trading Seminar

Trading seminars are a great way to exchange first hand with top-notch traders or other like-minded investors. You can also get insights on things that are not that easy to convey in online courses: trading psychology, real life examples, track records.

For some people it really unlocks something in their trading performance and they refer to the seminar as the point in time when their trading took a leap forward.

Another important point is that a seminar creates a community, and that bond can tremendously help you in overcoming the inevitable difficulties you will face.

A few well-known seminars

Seminars are usually much more expensive than online courses, but they will give you the real life experience. Some well-known ones include:

- Dan Zanger: a trading legend famous for having turned $10,775 to over $18,000,000 in under 2 years; as an alternative, Dan also has a famous newsletter (The Zanger Report) edited via his website Chartpattern.com;

- Mark Minervini is another Wall Street veteran and famous trader. His seminar is called the Master Trader Program, it has good reviews and is definitely one of the references in terms of Trading seminars;

- Warrior Trading: Ross Cameron is an acclaimed trainer. He proposes a range of options, from online courses to Chat Room access or full-blown Trader Masterclasses. Worth checking out, his Trustpilot rankings are outstanding.

Tip #6: Emulate the greatest traders

Learning from the greatest traders is both inspiring and thought provoking.

Along the years, I have researched hundreds of traders and strategies, and for Forex Trading I’ve shortlisted the best of them. They’re not all well-known, but all are highly skilled. You can find them in this article on 17 successful Forex Traders you can emulate.

A great way to learn more about these amazing traders is to read the Market Wizards series of books written by Jack D. Schwager.

I suggest you also learn from some of the world’s most outstanding traders in some great books that have been written on their success stories:

- Warren Buffett : the legendary Oracle of Omaha

- Ray Dalio : founder of Bridgewater Associates

- George Soros : the man who broke the Bank of England

- Jesse Livermore : the trader on which « Reminiscences of a Stock Operator » was based

- Ed Seykota : turned $5k into $15m in 12 years

- Richard Dennis : the man behind the fascinating « Turtle Traders » experiment

- Paul Tudor Jones : another legendary hedge fund wizard

Tip #7: Find some trade ideas using social trading

Exchanging trading ideas with other investors is a great way to break the isolation.

A few platforms will allow you to do that.

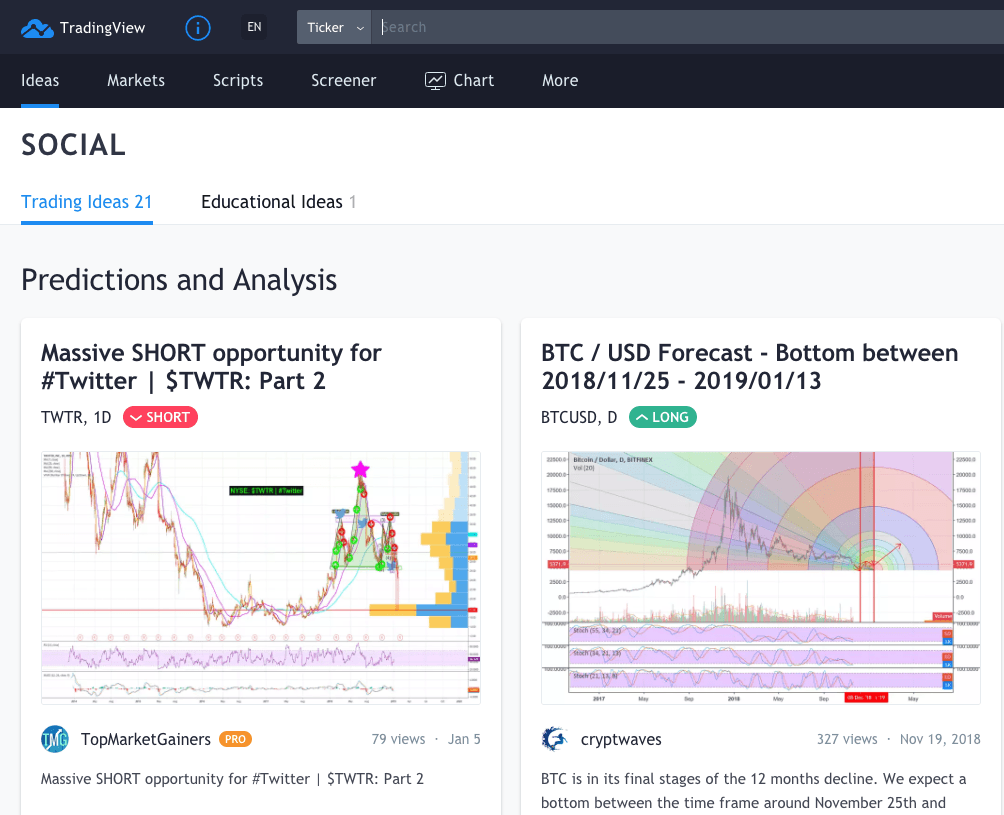

One of the best options is to use the social networking capabilities of TradingView.

This tool is amazing, it integrates one of the most powerful charting platforms with social trading, screeners, and it even has broker integration for those who want to trade from the charts.

Then, some brokers are totally oriented towards social trading. eToro is the most well-known, allowing you to connect with other traders, discuss trading strategies and even use the CopyTrader technology to automatically copy the trading performance of the best traders.

Tip #8: Learn to trade with Youtube videos

Videos are a great way to learn, and there is some very valuable content available free on Youtube.

Here’s a series of very useful videos, tackling the basics of Forex along with some psychological aspects of Forex Trading.

A video by Jayson Graystone : 10 ways to Learn Forex Trading

A good course on Forex Trading by Adam Khoo

Forex News Trading with Jarratt Davis

Probably THE best source there is for aspiring Forex Traders

Now let’s take a look at a different aspect of Trading with the more Long-Term approach of Dividend Investing.

Tip #9: Dividend Investing 101

A great form of passive income strategy is to buy dividend paying stocks.

This is a strategy quite similar to the buy and hold long term approach, except that you focus more on the regular cash flow from dividends than on the capital appreciation of your stocks. Investopedia has a series of introductory articles on dividends and dividend investing.

There are also some very good specialized websites for dividend investors, such as dividend.com, proposing a proprietary DARS rating to select and screen the best dividend stocks. I have tried it and can vouch for the quality of the selection.

If you want to take things further, check out this article around 12 Tips to buy Dividend Stocks.

Tip #10: Subscribe to Investment Newsletters

There’s a good number of newsletters available for stock pickers. They can provide you with lots of trade ideas. Here’s a list of some interesting ones, some free, some paid:

- Morning Brew : a free daily delivery of the top business stories

- Income Investor : published by Gordon Pape, recommended securities for an 8% yearly return

- Thoughts from the Frontline : written by John Mauldin, it is one of the most read weekly newsletters in the investing world, published weekly

Tip #11: Subscribe to online paid Investment Research Services

Paying for research can be a good option if you’re out of ideas or don’t have the time to do the research. Some very good subscription services are available such as Investors Business Daily (IBD), created by William J. O’neil the founder of the CANSLIM model. You can also give Zacks a try or Morningstar, both very well-known stock advisory services.

Tip #12: Take a riskier approach and learn options trading

In case you want to take a more aggressive approach to trading, you can turn to options.

Essentially, an option allows (but doesn’t require) an investor to buy or sell an underlying asset at a predetermined price (strike price) over a precise period of time. You will have two types of options: Call options (option to buy) or Put options (options to sell).

A lot of brokers offer options, check this Options Basic Tutorial if you want to know more about those securities. I also have an article reviewing the Best Options Trading books.

Benefits and risks of options trading

On the one hand, options require smaller amounts of capital than buying stocks outright and they can be used to hedge or protect an investor from a downside risk.

On the other hand, you could end up exposed to unlimited losses if you’re not careful. You will also need to manage the time decay factor (evolution of the price as the expiration date approaches). Finally you’ll have to make sure margin requirements don’t build up too much in terms of trading costs.

All being said, good options traders are often among the most successful and mastering this asset class can put you in an entirely different league in terms of earnings.

Now that you’ve kicked off your education as a trader, you need to choose a good broker and start practicing on a demo account, time to move to Step 5.