Stock Trading has always had a unique appeal. A lot of people dream of making money from stocks. Either to generate some side income, prepare for retirement or maybe even quit their 9 to 5 job. I’m sure this must have crossed your mind at one point…

Well, even though stock trading can be very profitable, it is not going to provide you with a steady income overnight. It takes practice, a lot of it, and you have to start by educating yourself. If you’re just starting out, I’ve written an article on 20 ways to Learn Stock Trading. You can take a look it will give you a practical step by step guide.

Now, choosing your trading style is going to be one of your first logical steps, and then you’ll have to select the platform that best suits your needs.

This article will tell you why Robinhood, the controversial new app that is rocking Wall Street with its « commission-free trading », is probably a great option if you’re an aspiring swing trader with small order sizes, but maybe less so if you’re a day trader.

But before we dive in on the platform, let’s go back to a few basic concepts on trading styles.

Swing Trading or Day Trading ?

There are four basic trading styles, usually defined by the length of time you will hold your positions in the market:

- Scalping: ultra short-term positions, buying and selling in a matter of seconds or minutes;

- Day Trading: buying and selling assets during the same day. Basically, a day trader never holds a position overnight;

- Swing Trading: positions are held anywhere from a few days to a few months;

- Position Trading or Buy and Hold: a trading style for value or dividend investors, holding securities for the long run, usually several years.

My take is that Scalping is for specialists, it requires very specific skills and definitely very specific platforms with flawless execution and usually advanced technical analysis tools.

Day Trading or Buy and Hold, an easier path

Day Trading on the other hand is more appropriate for aspiring traders, and often attracts a lot of new investors. You can day trade mostly any market, usually traders will opt for Forex, Stocks or indexes.

To make a profit, you will need to benefit from intraday price movements, speculating within the session hours and closing all your positions before market closes. No position is carried overnight and the main thing you’ll need is a liquid and volatile asset.

Finally, swing trading and position trading are much more relaxed forms of trading. Since you‘ll be entering the market for a few days, weeks or even years, your exact price entries or exits will matter much less. Your analysis will usually rely much more on fundamental factors (company financials, fundamentals, product launches,…). And your transaction fees will also be a bit less important.

How to choose your trading style ?

Intraday trading requires excellent knowledge of the stock market, a good grasp of technical analysis and strong psychological skills. It is a stressful and demanding activity, and so it’s not for everyone.

Alternatively, swing or position trading require different skills. The ability to judge a company’s fundamentals, its competitive positioning, the quality of its products. As such, it can be more accessible to new investors or traders, less accustomed to technical analysis and complex order entries.

Investopedia has a very detailed article going into the different trading styles, it can also provide some valuable insights.

Some successful traders to inspire you

It’s a fact, very few traders are consistently profitable. Brokers regularly publish their customer’s success rate and it is commonly accepted that 96% of traders end up losing money and quitting.

If you want to read about some successful traders, I’ve put up a list of 17 forex traders you can emulate. Some of them are successful day traders, others are swing traders, but they each have their unique take on the market.

Now let’s take a look at Robinhood, the commission-free platform, and see how it can fit your trading style.

Robinhood, the fastest growing trading app

Robinhood is an ultra low-cost broker that claims it wants to « democratize the American financial system ». It has made stock trading easily accessible to novice traders, even with very low capital and it’s a favorite among mobile-savvy millennials.

Robinhood is a free-trading app that charges no commissions. It has been one of the fastest growing apps since its launch in 2013. It now has more than 6m users and has surpassed leading platforms such as e*Trade. Valued at around $5.6bn, it is now tackling the banking market with an offer of a 3% checking and saving account.

It is available on your mobile or desktop, and the ultra low-cost approach means the platform is light, no-frills and doesn’t provide all the elaborate functionalities available with other brokers. Quite a bare bone approach in fact.

Another Stanford roommates story

In 2013, two Stanford roommates (Baiju Bhatt and Vlad Tenev) who had already created two finance companies, noticed that big Wall Street firms were paying next to no fees to trade stocks. They decided to launch an app that would democratize access to the financial markets, with a commission free model accessible to retail traders. Robinhood was born.

Where is Robinhood available?

Currently Robinhood is only available in the US, they do not take on any overseas investors. Licensed in 52 US states and territories, the company is based in Menlo Park, CA.

Robinhood alternatives for overseas traders

Since Robinhood isn’t present in Europe, there is currently a race among startups to launch a similar commission free broker that would emulate Robinhood’s success.

Revolut in the UK are a fast growing fintech startup. They have announced plans to develop a commission free stock trading platform similar to Robinhood. Freetrade (another UK startup) should launch around March 2019 and Dabbl or Investr have either launched or are planning to launch similar services. Investr claims to open accounts from anywhere in the world.

Robinhood runs on mobiles and PC

Robinhood is available on all iOS devices (iPhone, Apple Watch, running IOS 10 and above) and Android handsets running Lollipop 5.0 and above. Tablets are not specifically supported but the Robinhood mobile apps will run on all tablets.

Robinhood Web also supports Chrome, Safari, Firefox, Edge, and Internet Explorer 11. It works on both Macs and PCs.

The Robinhood app at a glance

Zero minimum deposit

There is no minimum deposit on Robinhood if you’re on a Standard Account. If you have a Gold Account (see below), you will have to deposit at least 2000$. Since the deposit will form your trading capital, you need to transfer at least the amount necessary to purchase the shares or funds you’re aiming for.

Such low funding requirements are a real differentiator versus other brokers. And this is where Robinhood has an edge. If you’re just starting out, or have limited capital that you want to invest, say less than 1000$, then Robinhood is your solution. In fact, you don’t have many alternatives.

Robinhood can literally let you try your hand at the market.

Account funding is easy

Funding your account has to be done through a bank transfer. You have an option to link your bank account to send funds.

Robinhood is linked with many major banks in terms of verification, avoiding you the trouble of reporting micro-deposits to your account to verify information. Bank transfers of up to $1,000 are available instantly to start trading, deposits larger than $1,000 will usually take four to five business days to appear.

Note :

You also have an option to set up automatic deposits on a weekly, biweekly, monthly or quarterly schedule.

Three types of accounts: Instant, Gold, Cash

Robinhood offers three types of accounts, depending on your financial needs:

- Robinhood Instant: this is the account you will create by default when you sign-up, giving you access to instant deposits and extended trading hours.

- Robinhood Gold: gives you access to larger instant deposits and will increase your buying power

- Robinhood Cash: this account does not give you access to instant deposits or instant settlements, but you can trade commission free during standard and extended market hours .

Downgrading to a Cash account

You can actually downgrade to a Cash account by following these steps: Tap Account -> Settings -> Robinhood Gold -> Change Tier -> Downgrade Account

You can trade 5 types of assets

Five types of assets can be traded with Robinhood:

- Stocks, but not penny stocks (OTC securities are not supported). Robinhood offers more than 5000 equities traded on US markets

- ETFs : all main Exchange Traded Funds listed on US Exchanges

- Indexes

- Cryptos : Bitcoin (BTC), Bitcoin Cash (BCH), Bitcoin SV (BSV), Dogecoin (DOGE), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC)

- ADR (American Depositary Receipts) for over 250 overseas companies

Opening an account is easy and takes a few minutes

To apply for a Robinhood account, you need to:

- Be 18 years or older;

- Have a valid Social Security Number (not a Taxpayer Identification Number);

- Have a legal U.S. residential address within the 50 states or Puerto Rico; and

- Be a U.S. citizen, U.S. permanent resident, or have a valid U.S. visa

All you need to do is submit an application in the Robinhood app. You will receive an email within one day that either confirm’s your application or asks you for some more information (documents to verify your identity for example). If such documents are requested, it will take five to seven days for them to review it and confirm your account.

Low-cost : commissions free

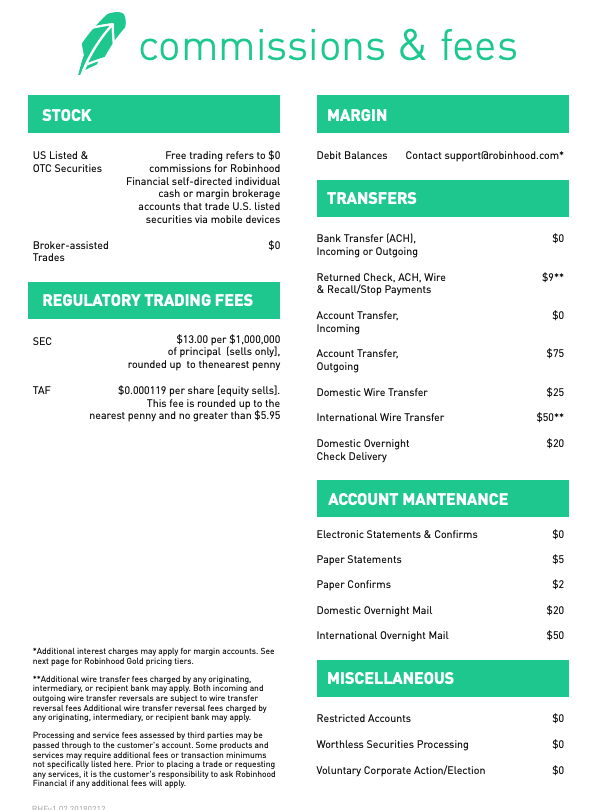

Robinhood charges zero commision on in-app trades. There are no hidden fees, with no inactivity fees, and no ACH or withdrawal fees. You will however have to pay a $75 fee if you want to move your account to another broker.

Here are the Commission Fees and Rates practised by Robinhood.

If you compare that to other brokers, this is very competitive because most will charge you $5 upwards for any small trade. But be careful, there’s a catch, Robinhood actually makes money on every trade, we explain that in a section below on “how do they make money?”

All great traders will tell you

Success in trading will be defined by your mental ability to manage losing periods while remaining consistent in applying your strategy.

Getting started: how to make a trade

You’ve opened your account and sent some funds, now you’re ready to make your first trade.

The steps are quite simple, just follow them one by one. On iOS and Android :

- Navigate to the stock’s Detail page

- Tap Trade

- Tap Buy

- Tap Order Types in the upper right order.

- Select your preferred order type.

- Confirm your order

- Swipe up to submit your order

Boom, you’re done. Couldn’t be much easier than that right ?

Robinhood supports market orders, limit orders, stop limit orders and stop orders.

Born Mobile

Robinhood is natively mobile. It was born that way. The whole experience was primarily designed to be mobile.

You will find that screens and charts are extremely simple, easy to navigate, with no confusing menus.

That means you can trade from anywhere, on the fly. No need to wait for your PC or laptop. And when you’re Day Trading, speed matters, because you have to keep monitoring your open positions. Robinhood just makes it easy to take your trading room everywhere with you.

Extended market hours

Since August 2018, Robinhood makes extended market hours available to all, for free.

Usual market hours in the US are 9:30 am to 4:00 pm Eastern time. The extended market hours allow you to invest pre-market and after-hours, from 9:00 am to 6:00 pm. That means you can start investing 30 minutes before the opening bell session and keep going two hours after the close.

Why is that interesting ? Well, for a start, some companies schedule quarterly earnings disclosures just before or after normal market hours, and with extended hours you can take positions without waiting for either the opening bell or the next day open. Besides, you will be able to act on the basis of news coming from foreign markets even though you’re out of normal US market hours.

Robinhood does have its limitations

Little education but some market news

Understandably, free trading means you’re not going to get many of the bells and whistles available on more expensive platforms.

There are no detailed courses to teach you how to trade, but in the help section you do get a few articles giving you general advice on Investing on Robinhood, with separate sections for stocks, ETF, options and cryptos.

Concerning market news, Robinhood has improved its offering in Nov 2018. You now get access to articles from Business Insider, CNBC, MarketWatch and Yahoo Finance, sorted by machine learning to appear when relevant to you. Robinhood claims to cover 92% of the stocks and cryptocurrencies available with market news.

Accessing the news is easy, it is right below your portfolio when you select specific stocks or cryptos, or by clicking the “Recent News” feed.

Very importantly, Robinhood also provides Morningstar analyst ratings, which is a pretty useful feature to judge the consensus on a particular stock.

No demo account or phone support

Another thing to know, Robinhood does not offer demo accounts. Paper trading is thus not possible, but with no minimum deposit you can test yourself with minimal capital, just a few dollars. I believe this puts you in better psychological conditions than pure paper trading because you will be testing your strategy and skills on real money.

There is no phone support either, nor do you get screeners or backtesting. Customer support is done exclusively through email.

Only one account

You can only open one taxable account (also called brokerage accounts) in Robinhood. That could be a limiting factor for you if you already have (or plan to have) a tax-advantaged 401(k) or IRA.

Commission-free trading: so how do they make money ?

Robinhood has some controversy around it. The “commission-free” claim has prompted many people to ask “How do they actually make money?”.

Robinhood is not a non-profit organization, so it’s fair to ask where they derive their income from. This is also important because as an investor you would not want to have your funds held at a company without a solid financial situation, as you would expect from a bank.

Robinhood makes money in three ways:

- Robinhood Gold: users are charged a monthly fee of $6 (see benefits below)

- Interest: Robinhood earns money from the cash and stocks held on customers’ accounts

- Rebates from market makers and trading venues. That means they get better prices for the stocks or assets they buy or sell on behalf customers, and collect the small difference. On high volumes that can represent quite a substantial amount.

Payment for Order Flow

There’s a very interesting article on the Wall Street Journal on Why free trading with Robinhood isn’t really free, explaining how sizeable rebates obtained for redirecting client’s orders can offset for some customers the effect of free commissions.

Robinhood sends orders to high frequency traders in exchange for cash, a practice called Payment for Order Flow, or P-Fof in the stockbroking world. The thing is, usually this enables Robinhood to get « price improvements » on the stocks their customers purchase, which means better prices than the normally available ones. And the whole question becomes, how much of that price improvement is passed along to customers?

Well unlike other brokers, Robinhood does not disclose the share of price improvement that is passed on to customers. Bloomberg has an interesting take on one of the most controversial practices on Wall Street, and so has the esteemed Financial Times.

Robinhood is not for everyone

Robinhood decided from the start what it wanted to be: a user-friendly app aimed primarily at millenials wanting to get into stock trading with a limited budget. And this is exactly what it is.

Which means that if you’re a seasoned trader looking for a trading platform with advanced features, elaborate charting or technical analysis tools, Robinhood is not for you. The mobile app is quite simplistic and the web version of Robinhood also keeps things at a minimal.

But if you’re just starting out, on a budget, with very little time, or you know exactly what you want to buy then Robinhood is a valid option.

In summary, Robinhood is best for :

- Mobile traders

- Swing or position traders

- Investors on a tight budget

- Investors making frequent trades of a few shares each time

- Traders who know what they want to buy

- Cryptocurrency investors

Note :

The important thing to remember is that when you make trades of a few shares at a time, the benefit of zero commission outweighs the fact that you’re not getting a price improvement, making Robinhood relevant for you.

Trading cryptos with Robinhood

Robinhood offers commission-free cryptocurrency investing. For the moment, it’s proposed on a state by state basis (37 states currently available, more to come, check the updated list here).

There are 7 available cryptocurrencies you can trade:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Bitcoin SV (BSV)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

You can also get market data for a number of other cryptos, such as Bitcoin Gold, Dash, OmiseGO, Ripple, and a small list of other coins. This is purely informative and is no indication that Robinhood would enable trading on these coins at any point.

Note however that Robinhood doesn’t currently support ICOs.

You can also trade ETFs and Options

Robinhood gives you access to over 2,000 Exchange-Traded Funds (ETFs). Basically ETFs are marketable securities that track a stock index, a commodity, bonds, or a basket of assets. They are usually low cost (compared to mutual funds) and many successful investors have come to recommend them quite strongly.

Note :

Read here if you want to know more about ETFs, but if you want a good insight on ETFs you can also read John C. Bogle’s (founder of Vanguard Group) « Little Book of Common Sense Investing ».

Options are a little bit more complex products, and Robinhood also offers commission-free options trading. Whether you buy or sell options, trading them is free, and you’re not even required to have a Gold Account. There are no base fees, no exercise and assignment fees and no per-contract commission.

Multi-Leg Options Strategies are even available since June 2018, so you can trade iron condors, straddles, strangles, call and put debit spreads and call and put credit spreads more efficiently and with lower capital requirements.

If you’re new top options, you can pick up one of the top options trading books.

Important :

Before you start trading options you will need to update your investment profile, and you’ll be requested to have prior stock trading experience before you are authorized to trade options.

Invest in foreign stocks via ADRs

In September 2018, Robinhood introduced global stocks trading, enabling customers to invest in 250 foreign companies via American Depositary Receipts (ADRs).

Investing in companies from around the world (China, Japan, Germany, Canada, France, UK) is now possible. You can own shares of Adidas, Ubisoft Entertainment, Tencent or LVMH even though they aren’t listed in the US.

An ADR is similar to a share, except that it is denominated in US dollars instead of its local currency. It still pays dividends and is subject to capital gains taxation in the US.

Robinhood announced checking and savings accounts at 3%: then backtracked…

The announcement rocked the financial community. Robinhood launched what they initially labelled as a 3% checking and savings account. It came with a Mastercard and no ATM, overdraft, transaction or membership fees of any kind.

This 3% just sounded too good to be true while conventional banks rarely offer upwards of 0.1%. So what was the catch?

The account was not a bank account but an investment account, closer to a money market fund. So Robinhood backtracked in Dec 2018, because contrary to what they had claimed, the accounts were not covered by the SIPC (Securities Investor Protection Corporation). The SIPC provides huge protection for investors who have securities or cash held at banks in the event of a failure.

Right now, Robinhood says it is going to work closely with regulators to prepare the launch of a cash management program. Keep an eye on any new announcement.

Robinhood Gold: worth it?

Robinhood Gold will give you the possibility to trade on margin, which is equivalent to borrowed money. For that, you need to be ready to have a minimum portfolio balance of $2,000, and you will be charged a monthly fee.

Understanding Gold Tiers

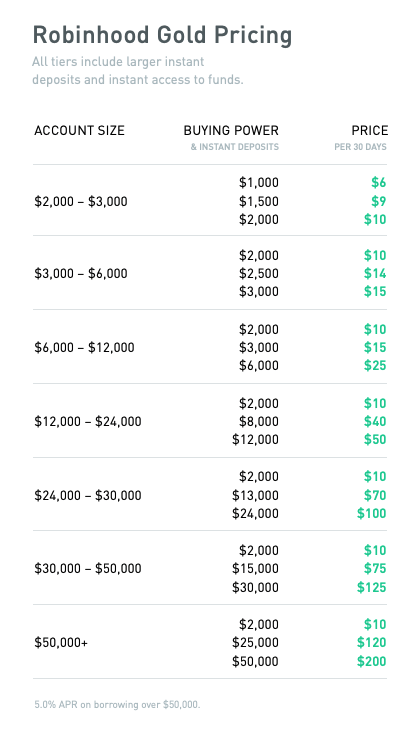

The bigger you account size, the larger your buying power, and the corresponding flat monthly fees, see below :

Robinhood gives a concrete example on its website

If you’re on the $200/month Gold tier, you’ll receive a charge for a 5% margin fee. For customers borrowing over $50,000 there’s an interest rate of 5% APR. For example, if you borrow $125,000, you’ll be charged interest on $75,000 ($125,000 – $50,000). The daily rate for borrowing $75,000 will be $10.41 ($75,000 x 5% /360).

Beware of margin trading

If you’re a new trader, be very careful of margin trading, it’s a risky activity because you can lose more than you invest. Of course, the upside is that you can increase your potential returns quite significantly.

Check out this article explaining in simple terms how margin trading works, and giving you a concrete example of how you could end up losing more than you invested.

How to Upgrade to Gold

Upgrading to a Gold account is easy. Just tap on the Account icon in the bottom right corner of the app screen, and tap Get Robinhood Gold. You will need to make sure your investment profile is updated, and that you have deposited at least $2,000 in your account.

How Safe are your funds ?

To assess your funds’ safety, you need to take a look at Robinhood’s Corporate Structure, different entities falling under different regulatory environments. With variable levels of safety nets.

This is the small print from Robinhood’s website

Robinhood Financial LLC and Robinhood Crypto, LLC are wholly-owned subsidiaries of Robinhood Markets, Inc.

Equities and options are offered to self-directed customers by Robinhood Financial.

Robinhood Financial is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC), which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash).

Cryptocurrency trading is offered through an account with Robinhood Crypto. Robinhood Crypto is not a member of FINRA or SIPC.

Cryptocurrencies are not stocks and your cryptocurrency investments are not protected by either FDIC or SIPC insurance.

What does this mean?

In simple terms, it means that the funds you allocate to stock, ETF or options trading are much better protected (up to $500,000) than the ones you allocate to Crypto trading.

Just keep that in mind when you decide to allocate funds. In case of increased turmoil or Black swan events this could prove vital.

Finding some Swing Trading strategies

Now if you’ve decided to give Robinhood a go, you might be on the lookout for some good trading strategies.

As I have said, I do not recommend Robinhood for Day Trading as the interface lacks the proper technical analysis tools and functionalities. Besides, Day Trading on a mobile handset is really not recommended, however Swing Trading can definitely be an option.

Note :

For some simple strategies, I recommend you take a look at TradingStrategyGuides, it offers some interesting Swing Trading Strategies. I also have an article on a Long Term Bitcoin Strategy you can try out.

Conclusion

You’ve come to the end of this complete Robinhood review. Time to sum things up.

Robinhood have definitely made a bang in the world of online brokerages with their mobile friendly commission-free model.

The platform is not for everyone, as it lacks a number of features that more advanced traders will be looking for. Clearly, day trading on Robinhood equates nothing more than fancy gambling, as with most mobile handsets for that matter.

But if you’re a new investor wanting to get your feet wet in the markets, maybe on a limited budget, hey Robinhood could well be a good option. So jump in, create your account and buy your first Stock or ETFs, you can do it with a few dollars and that’s all it will cost you.

Remember, Robinhood is good for traders making frequent trades of a few shares at a time, that’s when the zero commission model is most efficient.

If there are features or functionalities of Robinhood that you would like me to review in a bit more detail, just leave a comment below.

Trade safe.

Further reading

I hope this review will be helpful. If you want to thank me, buy me a coffee 😉

Thanks Leo, and safe trading to you

Thanks Jon. I haven’t tried the Schultz app, but bear in mind that Robinhood’s great if you have limited order sizes. It’s really convenient if you’re just getting started

Hey John, I heard about the Robin Hood trading app a few days back. I wasn’t sure if the claims it made were true so I decided to do some digging. As an aspiring stock trader, making a choice at this point is so overwhelming. I’m just in search of a guide that I can trust to give me the ideal recommendations for my goals. I want to be able to do this full time. Your article is very comprehensive and detailed as well. I’ll be sure to stick around.

Thanks for sharing

Hey what I really like about this is the way you have given me some real examples of real people in the form of readable stories. So often you get information like this in an almost précis form bland uninteresting and technical.

This has given me some real food for thought and I have spent longer on this site educating myself than I would on many others with like information but far less interesting to spend time on.

I have been trying to understand trading in recent months with a view to dabbling and I am reading as much as i can to try and build up a knowledge base before deciding what direction I would like to go in.

As a New Zealand based reader I am looking forward to when I can see the app here in the Souther hemisphere.

Thanks

Hamish

I did now know this much about the Robinhood app and I actually have it installed on my android phone. When did you learn about robinhood and how long have you been using the app on your phone? Do you prefer it to the way you were trading stocks in the past or is the no commission the best selling point on it? How does robinhood differ from the Schultz app?